Economic slowdown challenges insurance underwriting; emerging markets show promise

Swiss Re Institute analyst underscored that real premium growth in emerging markets, including China, outpaces the more advanced economies.

An anticipated global economic slowdown could put insurers in a time machine back to a 1970s-style stagflation scenario, beating down underwriting performance. This could potentially entail setbacks on the insurer’s liquidity, capital, and shareholder equity.

Swiss Re Institute’s (SRI) chief economist for Asia Pacific, John Zhu, warns that insurers find themselves at a crucial juncture, requiring strategic adjustments to navigate the shifting economic landscape.

“I think some slowdown, maybe just mechanically, from one year to the next, is going to happen. The US Federal Reserve, through raising interest rates sharply in 2023, tried to slow down the economy so that inflation can come back to target,” Zhu said in an interview with Insurance Asia.

Zhu outlined that global economic growth is projected to fall to 1.7% in 2024, stemming from deceleration in major economies like the US, the Euro area, and China. This slowdown, while hinting at a potential dip in short-term insurance demand, comes with nuances.

The US, resilient in 2023, deliberately slowing its economy, and China experiencing a slower-than-expected recovery, present a mixed bag of challenges and opportunities.

“China is a slightly different case, it had a relatively strong rebound, at least initially, at the start of 2023, as it reopened from some of the strict COVID restrictions they had, which has now been normalised. And it's now become evident that this economic recovery is slightly slower than maybe some have expected. And for 2024, again, we expect a slight slowdown in China's GDP growth,” Zhu said.

Whilst acknowledging the potential for slower growth in insurance demand, he pointed out that certain Asian economies, like Taiwan, are poised for accelerated growth in 2024.

“Overall, we still see growth in premiums in a lot of the emerging markets. The slowdown we’re seeing in Asia is slightly less of a concern. Because within Asia, there are economies that we forecast will go faster,” said Zhu.

“In the coming year in 2024, for example, an economy like Taiwan, is showing signs that manufacturing and the electronics cycle may be turning by 2024, in which case its GDP growth accelerates and is likely to be one of the economies that grow faster in 2024. That again, should be positive for insurance demand as well,” he added.

This regional disparity suggests that insurers, particularly in emerging markets, might find pockets of growth even amid the broader economic slowdown.

Horizon for emerging markets

Zhu's relative optimism extends to the realm of emerging markets, especially in the APAC region, where he predicts robust growth in premiums. Citing figures from the sigma report, he highlighted a significant divergence between advanced and emerging markets.

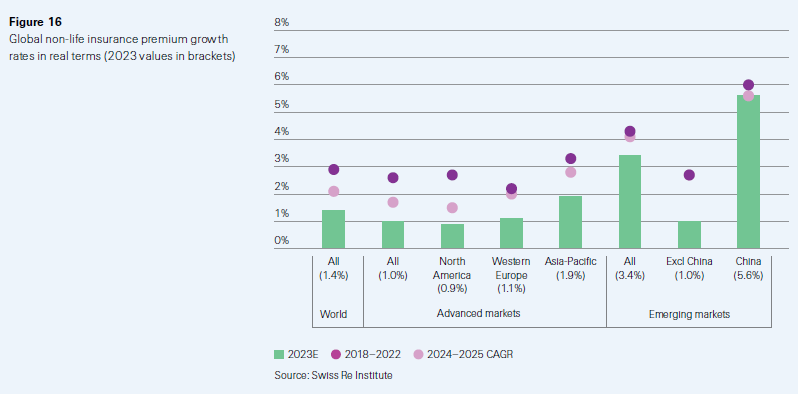

Swiss Re Institute's sigma report. Figure 16.

In SRI’s latest sigma report, it is projected that non-life real premiums in China will experience approximately 5.6% growth in 2023, with a similar trajectory expected in 2024 and 2025.

“The exit from the pandemic has boosted insurance demand. For example, motor premium growth has normalised after adjusting due to motor sector reforms,” the report said.

Structural economic weakness nonetheless translates into a growth profile that is clearly below historical trends (11.5% on average from 2016 to 2020). In any case, Chinese premiums are forecast to grow faster than those in other emerging markets (1.0% in 2023)” it added.

Real premium growth rates in emerging markets, including China, outpace those in advanced markets. With figures indicating 6.5% growth in China compared to the global average of 1.4%, insurers may find lucrative opportunities in less developed markets with higher growth potential.

Likewise, a report from GlobalData showed that China’s life insurance market is projected to jump 9.6%, “supported by economic recovery, conducive regulatory developments, and increased awareness of health and financial planning after the pandemic, which led to a rise in the demand for whole life and personal accident and health (PA&H) insurance policies.”

Forecasts also showed that the industry is expected to surge $890b in direct written premiums by 2028.

Similarly, its general insurance sector is seen to jump 6.9% in 2024, driven by “an increase in vehicle sales, investments in infrastructure projects, favourable regulatory reforms, and a post-pandemic rise in the demand for health insurance.”

By 2028, gross written premiums are seen to register at $361b.

Zhu emphasised the importance of insurers focusing on underwriting profitability, as claims growth could be higher than broader consumer price inflation, and surpass premium growth. “We think claims inflation is going to remain elevated, including in 2024. And so in most markets over the past few years, and going forward, we think the average growth in premiums has likely lagged the average growth in claims costs. Which means insurers need to really focus on underwriting profitability.” he said.

Finally, SRI’s chief economist cautioned that elevated inflation in items that insurers pay for, particularly in costs like wages and healthcare, poses an ongoing concern. Insurers must grapple with these challenges by adopting prudent underwriting practices and closely monitoring cost pressures.

Advertise

Advertise