Increase in profits still too slow for Taiwan’s insurance industry

For a developed country, insurance penetration remains low at 1%.

On the surface, Taiwan’s insurance industry may appear to be winning in terms of its financial report. But GlobalData is reporting otherwise, describing the industry’s growth to be moving at a “snail’s pace.”

The insurance industry recorded a 2021 pre-tax profit of $14.15b, according to the Financial Supervisory Commission. Out of the total, the life insurance industry’s profits reached $13.37b for the year, an 88.5% increase compared to 2020. Meanwhile, non-life insurers logged $780m in profit for 2021, a 32.9% increase from the previous year.

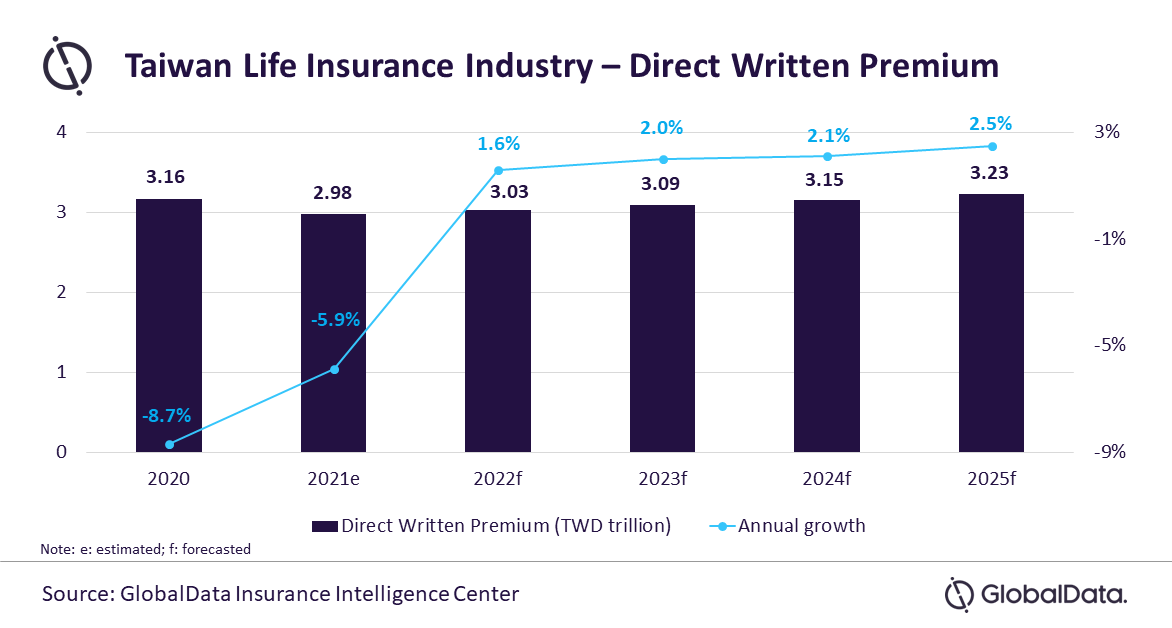

With the demand for foreign-currency-denominated investment products and the ageing population, the growth in life insurance is even expected to pick up in 2022. GlobalData, however, estimates that Taiwan’s life segment will only grow at a compound annual growth rate (CAGR) of 0.4%, from $107b in 2020 to $121.2b in 2025 in terms of direct written premiums (DWP).

According to GlobalData’s Senior Insurance Analyst Deblina Mitra, after contracting in 2019 following years of slowdown, the industry had further contracted in 2020. Mitra said this was mainly due to persistently low interest rates and capital market fluctuations that reduced yields from insurance investment products, lowering their demand. The trend continued in 2021 with a decline of 5.9%.

The report identified that the decline was most prominent in whole life, term life, and endowment business lines which collectively accounted for 75% of the life insurance DWP in 2020, registering a decline of 11.1%.

Amidst the snail-paced growth, the government has not been idle. In June last year, the regulator increased the limit for life insurers who are operating in foreign-currency-denominated insurance businesses, which offer better returns compared to the Taiwanese dollar, from 35% to 40%.

READ MORE: Taiwan insurance industry profits continues downward spiral

“Taiwan’s life insurance industry’s growth momentum is expected to remain subdued over the next five years as challenges related to adverse market conditions, declining working-age population, and an existing mature market will continue to oppress the demand. The demographic shift towards the super-ageing population is expected to be a focus area for insurers with more products being launched targeting this age group,” Mitra said.

Low penetration

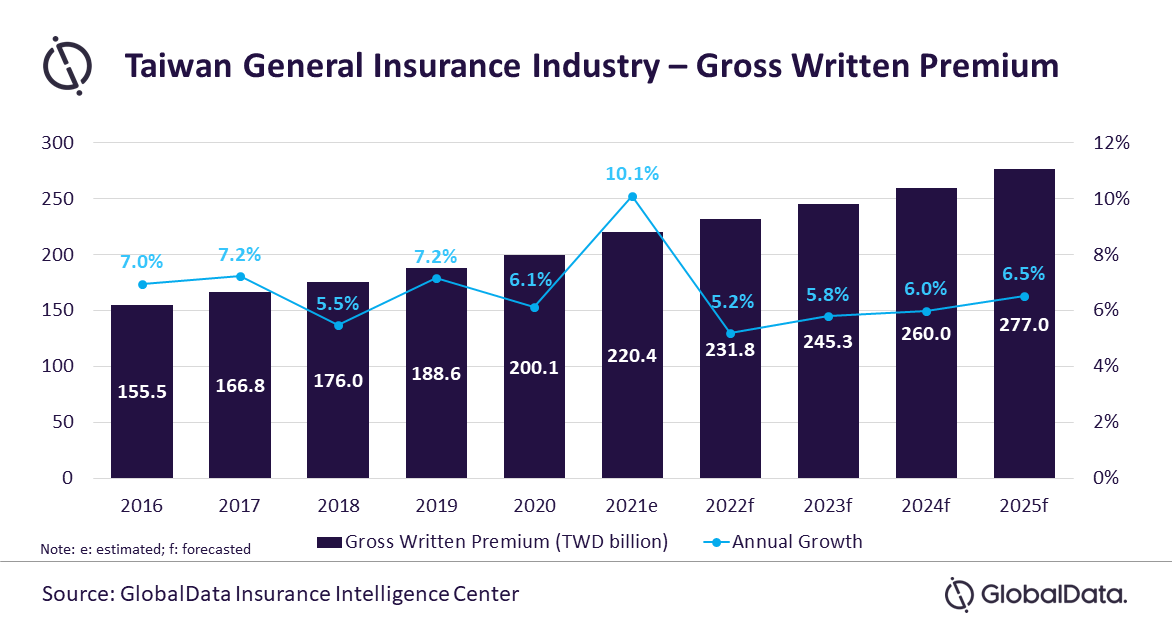

Meanwhile, the general insurance industry may have logged a greater CAGR than the life segment, but it remains to be inconsequential on the grounds that general insurance penetration in the country is very low.

The industry is currently growing at a CAGR of 6.7% to $10.4b in 2025 in terms of gross written premiums (GWP). However, Mitra pointed out that despite Taiwan being a developed economy, the penetration rate, as a percentage of the gross domestic product (GDP), is at 1%, which is way below the developed markets’ average of 4%.

Mitra blames this on the low uptake of insurance lines such as property and liability.

What most affected the industry is the decline in motor insurance which accounts for 53.7% of the general insurance industry’s GWP. Despite getting a boost from an increase in premium prices and strong growth in vehicle sales, the outlook for motor insurance, in the short term, remains negative due to the global shortage of semiconductors used for motor vehicle production.

However, Mitra observed that Taiwan’s low insurance penetration and strong export-oriented manufacturing sector provide ample room for the growth of the insurance industry.

“Stable economic factors coupled with the government’s initiatives to expand the general insurance industry through new product development are expected to support its growth over the next five years,” Mitra said.

The government, for its part, has been introducing several resolutions to bridge the insurance gap. One example is the Farmers’ Insurance Act in 2021, which prompted insurers to develop solutions such as covering risks faced by farmers. This has positively raised the CAGR of the property insurance lines by 5.3%.

National health insurance

One of Taiwan’s edges in the insurance industry is the government’s National Health Insurance (NHI) under the National Health Insurance Administration (NHIA). The NHI was first introduced back in 1995 and has undergone many changes.

In the “An overview of the healthcare system in Taiwan” paper by Tai-Yin Wu, Taiwan’s healthcare was said to be characterised by good accessibility, comprehensive population coverage, short waiting times, low cost, and the use of national data collection systems for planning and research.

However, it is still plagued by problems, namely the quality of outpatient visits, a weak referral system, and its financial capabilities.

For its outpatient problems, the paper said that the health-seeking behaviour of Taiwan is at a very high level. Meaning it is part of Taiwanese culture to take medicines or seek medical help frequently, even for minor ailments. In fact, outpatient visits per person can sometimes be up to 14 times per year, a substantially higher rate than in other countries with the same NHI such as the UK.

This results in general practitioners always seeing a minimum of 50 patients per morning, which amounts to about five minutes per person. This short time may result in poor patient-physician rapport and hasten medical judgment. As a result, many patients often inquire for a second or even third opinion contributing to even higher patient volumes and higher medical costs.

Problems such as this are now being addressed by the NHIA. According to its annual report, NHI is now strengthening primary care capabilities and developing effective cooperation mechanisms amongst primary care clinics and hospitals.

This is in hopes of enhancing not just medical quality and capabilities but also that primary care providers such as doctors can offer the public more superior care services to reduce the burden on large hospitals so they can direct their focus on emergency and critical care.

Advertise

Advertise