Indonesian insurers’ old-school thinking holds back sector

The industry must digitise to tap the nation’s vast Gen Z and millennial consumers.

An inadequate digital infrastructure has hampered information technology (IT) adoption by Indonesia’s insurance industry despite a government push to fast-track the use of tools such as cloud computing, artificial intelligence (AI), and blockchain, analysts said.

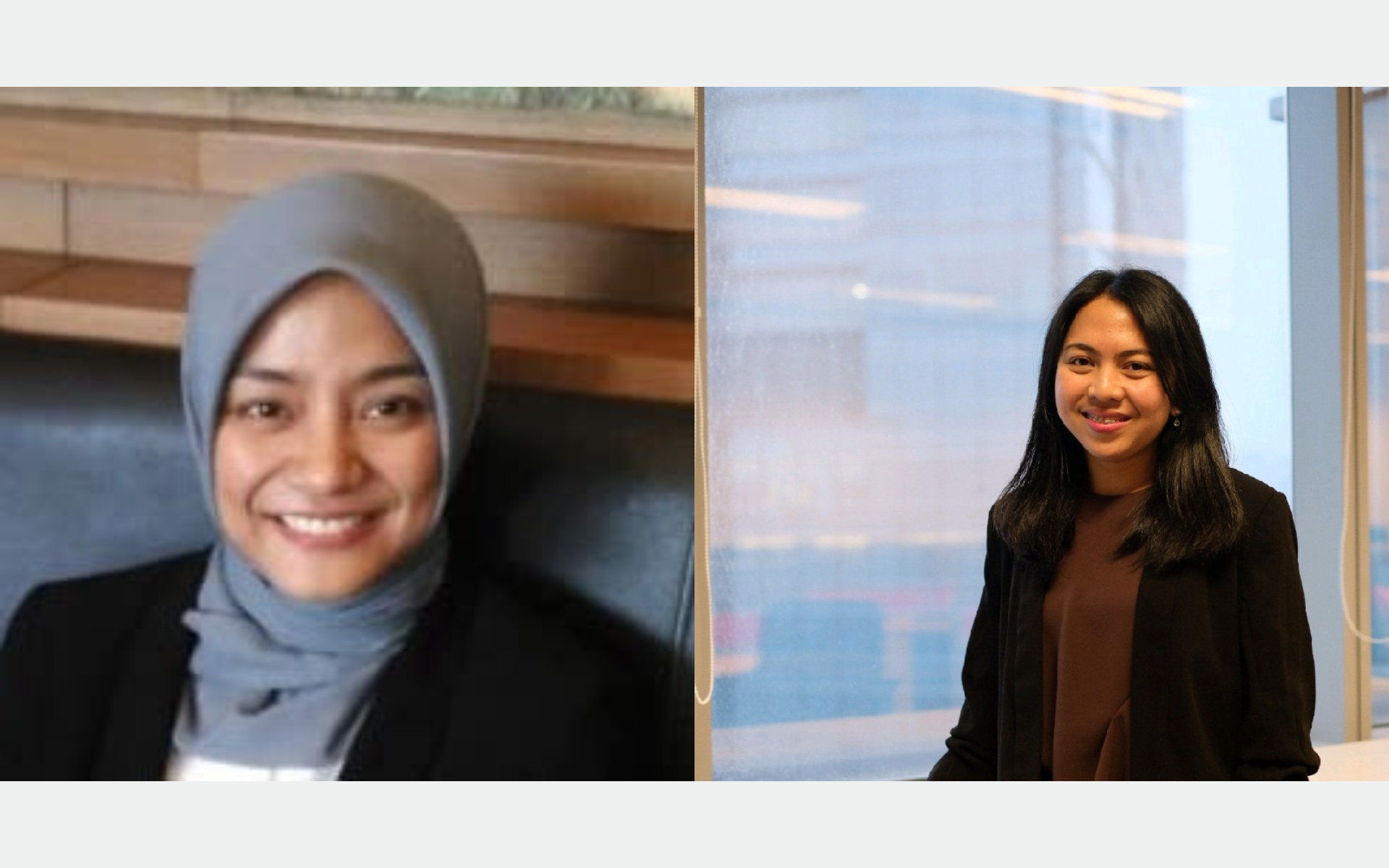

Apart from the Southeast Asian nation’s unreliable internet connectivity, the investment needed to implement advanced IT systems is substantial, Jessica Pratiwi, associate director and Femmy Novaryani, senior analyst at Fitch Ratings’ Asia Pacific insurance team, told Insurance Asia.

/Jessica Pratiwi (left), associate director and Femmy Novaryani (right), senior analyst at Fitch Ratings’ Asia Pacific insurance team.

The high cost could strain smaller insurers whilst the sector strives to meet stricter global accounting standards, they added.

The recent surge in cyberattacks has also heightened concerns about data integrity and customer trust, dissuading many insurance companies from going digital.

“Challenges in data encryption and integrating advanced technologies like cloud computing and AI further complicate the adoption,” the Fitch Ratings analysts said in an emailed reply to questions.

Indonesia’s insurance penetration was 1.39% at the end of 2022, according to the ASEAN Insurance Council, largely due to fewer than half of its citizens being financially literate. Top-ranked Singapore had 10.49%, Thailand 5.02%, Vietnam 2.51%, and the Philippines with 1.98%.

Southeast Asia’s most populous nation must improve financial inclusion if it wants to tap its burgeoning middle class and a large cohort of Millennial and Gen Z consumers who are now coming of age, Deloitte said in an October 2023 report.

A 2023 survey by the Otoritas Jasa Keuangan (OJK), Indonesia’s Financial Services Authority, showed that only 56% of local insurance companies use IT, whilst 38% have not fully embraced digital marketing channels.

“We believe advanced technologies such as AI can help to detect, identify and respond to unusual patterns and risks more quickly,” Pratiwi and Novaryani said. “Automation can be used to reduce risks of cyberattacks, not to mention incidents from third-party cybersecurity technology companies.”

But the financial regulator must come up with clear guidelines to support the adoption of IT and data security measures by the insurance sector, they said.

Collaboration amongst insurance companies and technology providers, including sharing infrastructure and resources for IT and cybersecurity, could cut the cost and encourage IT integration, they added.

“Cloud computing provides scalable and secure infrastructure and tools, whilst AI enhances data protection through real-time threat detection and advanced analytics,” Edy Widjaja and Rafael Lam, partners at Bain & Company, told Insurance Asia.

/Edy Widjaja (left) and Rafael Lam (right), partners at Bain & Company.

Lukas Bower, Ernst & Young Global Ltd’s (EY) Asia-Pacific financial services generative AI leader, said Indonesia could learn a lot from its neighbours, where there has been a rapid adoption of AI in specific areas such as contact centres.

/Lukas Bower, EY Asia-Pacific financial services generative AI leader.

“Post-COVID, we've seen a surge in call volume, with many physical branches closing down and the complexity of customer inquiries increasing,” he said. “AI is being used to summarise calls, create tickets for actions or claims in insurance, and generally save time.”

But businesses still tend to keep a human in the loop, he pointed out. “They aren't allowing AI to control the entire customer interaction; usually, the AI handles the initial part of the interaction and then routes the customer to a live agent.”

He added that whilst blockchain is often heralded as a game-changing technology, its practical application in insurance remains limited.

“Blockchain technologies can also be expensive to run and manage, so insurers need to carefully consider the cost versus the benefit,” Bower said. “Could another technology deliver the same outcome at a lower cost and with less risk?”

The global blockchain in the insurance market was worth US$766m in 2022 and is expected to grow to US$33.5b by 2030, or a CAGR (compound annual growth rate) of 61.2%, according to Fortune Business Insights.

Intense competition

The analysts said Indonesia should look at more advanced markets for guidance. In Singapore and Australia, insurers have managed to integrate IT and AI to improve operations and customer service.

“Singaporean insurers have used AI to personalise customer interactions, streamline operations and find customer cross-sell opportunities,” Widjaja and Lim said. “These examples provide valuable models for the Asia-Pacific region, demonstrating how strategic investments in technology can drive competitive advantage and operational improvements.”

In December 2020, China issued rules for the rapidly growing Internet insurance sector.

Fitch’s Pratiwi and Novaryani said Chinese insurers have been expanding their digital presence, and new technologies such as big data, cloud computing, AI and blockchain would continue to change the way insurers serve their customers.

“Ongoing technological shifts will pose challenges as well as bring opportunities to the Chinese insurance sector,” they added.

Meanwhile, Malaysia’s central bank in June finalised the regulatory framework for digital insurers and takaful operators — a type of Islamic insurance where members contribute money to a pool system to guarantee each other against loss.

The rules are meant to plug protection loopholes and improve service, whilst boosting insurance and takaful penetration to as much as 5% of economic output by 2026, from 3% in 2022.

EY’s Bower said regional competition is intense, especially with fintech startups around. “They move quickly and can do so because they're leveraging these modern technologies, which is a significant advantage.”

For Indonesia’s insurers — and regulators — the challenge is how to keep up with the global insurance market’s technological evolution.

Regulations would increasingly require insurers to monitor compliance with breaches, for instance, in real-time, rather than giving them time to fix a problem, he said. “As transactions and customer interactions happen, it's no longer acceptable to simply address breaches after the fact; you need to prevent them before they occur.”

Whilst these regulations may take some time to reach Indonesia, they will eventually, he pointed out. Companies that are prepared will have a competitive advantage because they won't need to spend as much just to comply with new rules, he added.

Bain’s Widjaja and Lim said they expect regulatory frameworks in Indonesia to adjust, with a particular focus on data privacy, transparency, and cybersecurity.

“We expect the regulatory environment for AI in insurance across the Asia Pacific region, including Indonesia, to become more structured and focused on ethical considerations and transparency,” they said.

“Insurance companies should stay informed about these regulatory developments and be prepared to adapt their AI strategies accordingly,” they added.

Advertise

Advertise