Singapore Business Review’s Insurance Rankings sees slow growth amongst top 50 insurers

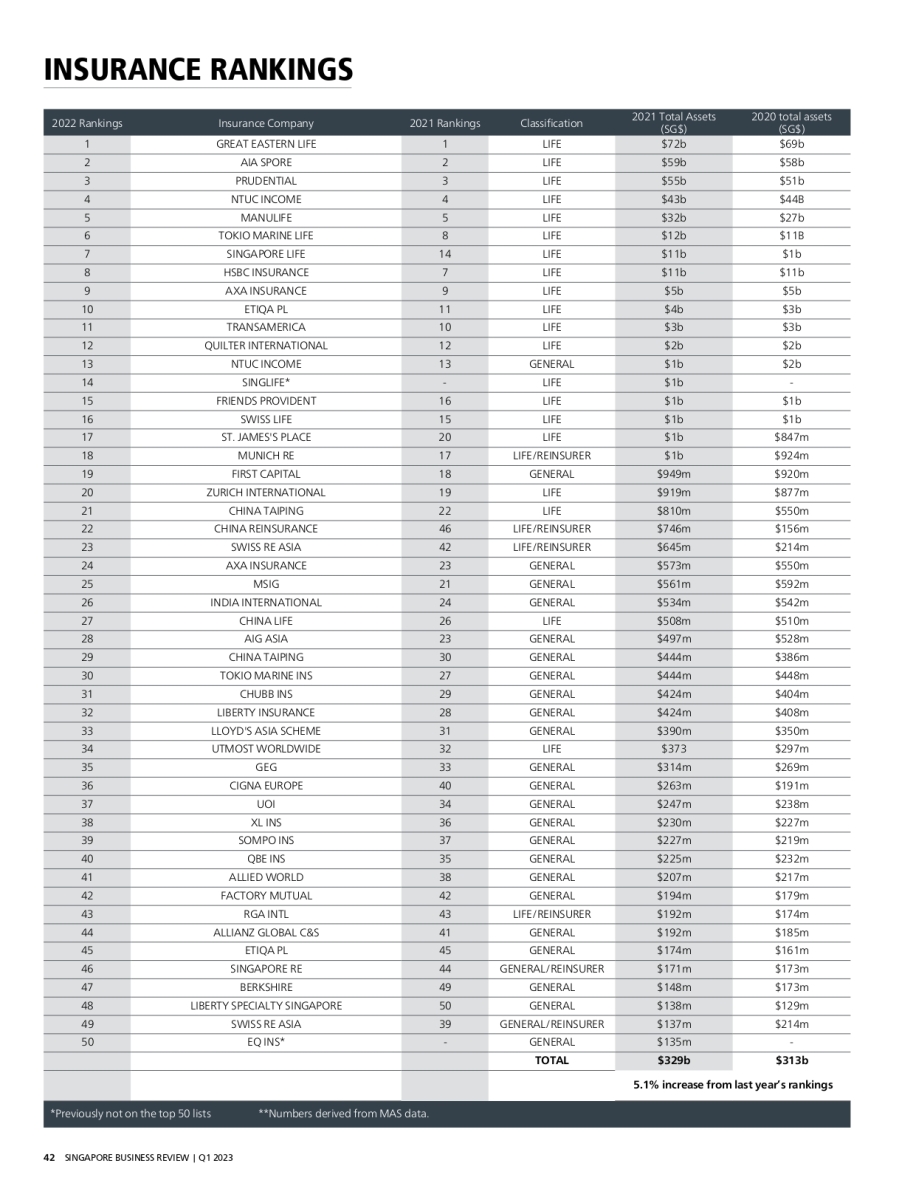

The top 50 insurers saw 5.1% growth in 2021.

Singapore’s top 50 insurers included in the Singapore Business Review's Insurance Rankings grew by 5.1% in 2021, tapering off from the double-digit growth observed in the previous rankings. This is because in 2021, according to the Ministry of Trade and Industry, life insurers suffered a decrease of 23.5% in their net income brought by lower investment income.

The Singapore Business Review Insurance Rankings is the annual list of the top 50 insurers in Singapore by assets. The data is derived from the Monetary Authority of Singapore’s annual statistics with the most recent rankings using data from 2021 and comparing them from a year before.

The annual review of the insurance sector saw 20 life insurers, 24 general insurers, four life reinsurers, and two general reinsurers in the top 50 list.

Great Eastern retained its first place, with a 4.35% increase in assets. AIA also maintained its rank at second place with a 1.72% increase in assets.

Prudential, NTUC Income, and Manulife all retained their third, fourth, and fifth spots, respectively, with Manulife experiencing the greatest asset growth amongst the three at 18.51%. NTUC Income however decreased by 2.32% despite maintaining its fourth rank. Prudential’s assets increased by 7.84% compared to a year before.

Amongst all the general insurers, NTUC Income’s general insurance business has the highest assets in the rankings at number 13.

This year also saw the return of Singlife to the top 50 at rank 14 and a newcomer, EQ Insurance, at rank 50.

Meeting consumer demands

Speaking with Singapore Business Review, Goh Theng Kiat, Chief Customer Officer at Prudential Singapore, said that in 2022 they saw more consumers rely on technology for their health and well-being as well as financial stability. In their “Digital for 100: Harnessing technology for longer lifespans” research, they found that 54% of Singapore residents say that mobile devices and apps are critical tools in preparing for rising longevity.

Goh Theng Kiat, Chief Customer Officer at Prudential Singapore

“Of those who are using technology to manage their well-being, 36% say that digital tools have had the greatest positive impact on their financial situation, and 27% on their personal health. Respondents used mobile apps to monitor their health such as physical fitness, blood pressure and sleep, as well as their bank accounts, CPF and insurance needs,” Goh said.

This is why Prudential continues to improve its digital health and wellness app, Pulse. Apart from allowing users to assess their health through the Pulse app, it can also help them plan their finances with the use of its AI digital assistant.

Consumers also demanded more choices and expected tailored services to suit their individual needs. Prudential created products such as PRUActive LinkGuard, an investment-linked whole life insurance plan, that allows customers to adjust their coverage, and make regular or lump sum top-ups or partial withdrawals when needed.

For Manulife Singapore CEO Dr Khoo Kah Siang, 2022 saw the need for businesses to develop highly skilled and adaptable workforces and introduce more agile ways of working. Businesses must also find more ways to attract new talent and retain existing ones.

“At Manulife, we introduced an industry-first IBF-certified training programme to upskill our financial representatives and annual learning fiestas for employees to learn more about insurtech, blockchain, artificial intelligence and analytics. Such learning programmes serve to ensure our employees stay ahead of trends that are disrupting the insurance industry,” Dr Khoo said.

Dr Khoo Kah Siang, CEO, Manulife Singapore

As the impact of COVID-19 receded, Dr Khoo said that the focus shifted towards climate change and sustainability.

For businesses, this means creating products or strategies for a sustainable business, providing products with longevity, and contributing positively to climate sustainability. Manulife launched its own Impact Agenda in June last year, which outlined its key social and environmental commitments, in areas where it can have the greatest ability to affect change.

Businesses also saw the value of personalisation and for Ho Lee Yen, CEO of HSBC Life Singapore, this increased in 2023.

“This is the next evolution of "being where our customers are." Organisations that are able to effectively leverage data and analytics to personalise their engagement and solutions will be able to capture mind and market share. In the insurance business, the level of personalisation we can achieve can make a difference in how effectively we can support our customers in reaching their goals in the various aspects of wellbeing,” Ho said.

Ho Lee Yen, CEO, HSBC Life Singapore

Trends for life insurers

Manogna Vangari, Insurance Analyst at GlobalData said that in 2022 some insurers increased their investments in insurtech to improve operational efficiencies and their overall profitability.

“For example, AIA implemented plans to shift 90% of its operations to the cloud by the end of 2022. Prudential Singapore is experimenting with machine learning-based solutions to automate claims and reduce fraudulent practices,” Vangari said.

Manogna Vangari, Insurance Analyst, GlobalData

She advised that insurers, especially life insurers, should focus on insurtech developments to address demographic challenges and provide personalised insurance policies to meet the changing financial demands of customers by offering more flexible insurance coverages.

“In 2023 and beyond, geopolitical tensions, cyber risks, supply chain disruptions caused by Russia and Ukraine conflict, sustainability, and ILS market development will become increasingly pertinent issues and key focus areas for the non-life insurers,” Vangari said.

Lim Siang Thnia, Deloitte Southeast Asia Insurance Sector Leader said insurers will face a volatile geopolitical environment this year.

“This will likely affect the investment outlook, particularly for life insurers, consumer behaviour and also employee expectations. Hence, insurers need to be agile and adaptable to manage emerging challenges. Some of the value of the prior investments will likely be demonstrated (or not) this year. In addition, adjusting to what is likely to be a hybrid working environment and the challenges it poses, whilst remaining competitive and customer-focused with an eye on the bottom line will be a balancing act that insurers need to manage.” Lim said.

Lim Siang Thnia, Insurance Sector Leader, Deloitte Southeast Asia

Targets for general insurers

Ho Kai Weng, Chief Executive of the General Insurance Association of

Singapore (GIA) said they are several trends last year that may remain in 2023.

One of them is how workplace and manpower trends such as hybrid and remote working will remain.

“Insurers must adapt to the office of the future. A strategic approach to training and upskilling talent will be critical to ensure that insurers remain competitive in the global talent war,” Kai Weng said.

In Singapore, most senior executives have prioritised employee engagement and retention strategies over consumer behaviour or geopolitical concern. However, only 30% are prepared to respond to a dearth of talent and skills availability, a study by Russell Reynolds Associates revealed.

“The tech layoffs of late 2022 may create new opportunities for insurers to grow their ranks, something previously challenging given the shortage of tech talents. Insurers with particular requirements for new skills in technology can leverage the availability of skilled tech talent to support their digital transformation roadmaps,” Kai Weng advised.

Ho Kai Weng, Chief Executive, General Insurance Association of Singapore

General insurers should also expend efforts in providing cyber insurance to small and medium enterprises (SMEs). A report by QBE revealed that 42% of SMEs in Singapore have indicated that they conduct seven to eight processes online but lack basic protection for these technologies. 21% of SMEs have also said that they have been ‘hacked into’ at some stage back in 2019.

“This is worrying given that SMEs account for 99% of businesses in Singapore and employ more than 70% of the workforce. Any large-scale cyberattack would potentially mean widespread losses. This, hence, underscores the urgency for insurers to step up efforts and educate businesses on the importance of cyber insurance,” Kai Weng said.

Kai Weng added that since the pandemic, greater awareness towards protection has been prevalent amongst consumers.

“At the back of an uncertain macroeconomic environment, sustained inflationary pressures, increasing sophistication of cyber threats, and climate change, there will no doubt be a new wave of challenges posed for insurers. Against this volatile landscape, there is a need to adjust operations accordingly to cope with the unknown as this could mean large and unexpected liabilities and the consequent increase in claims and costs. With this trend, therein exists an opportunity for insurers to innovate and deliver products with strong value propositions that meet these,” Kai Weng said.

Advertise

Advertise