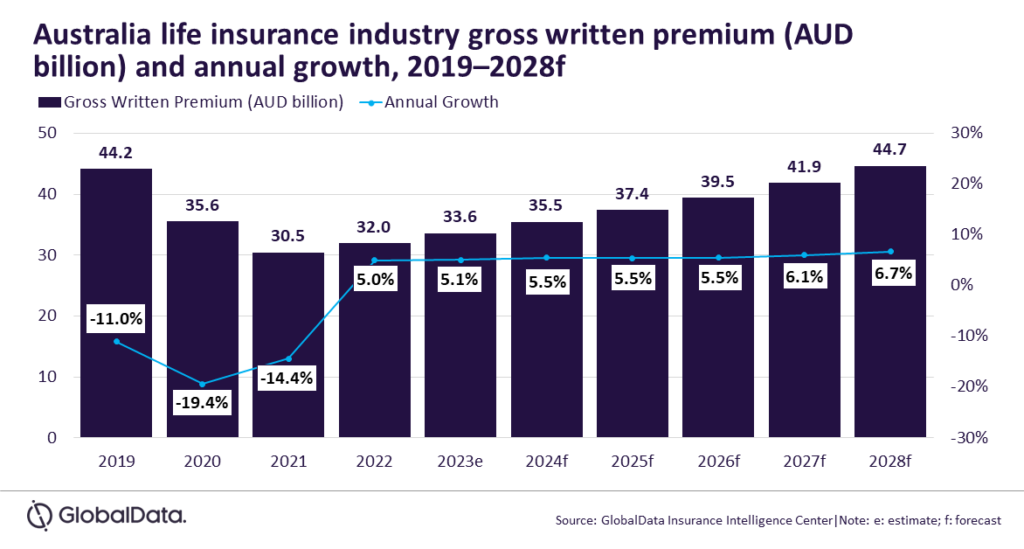

Australia's life insurance to grow 5.9% CAGR by 2028

Favourable macroeconomic and demographic factors will be catalysts for its 2024 performance.

Australia’s life insurance sector is forecasted to surge a compound annual growth rate of 5.9% (CAGR) from $23.3b in 2023 to $30.4b in 2028, in terms of gross written premiums (GWP), GlobalData said.

“The Australian economy is recovering from the high inflation faced during 2022-23. The gradually stabilizing economy and increasing insurance awareness will present opportunities for the growth of the life insurance industry over 2024 to 2028,” said Sravani Ampabathina, Insurance Analyst at GlobalData in a media release.

According to GlobalData’s Insurance Database, the Australian life insurance sector is set to accelerate its growth trajectory in 2024, driven by favourable macroeconomic and demographic factors.

These factors include a stabilising economy, an ageing population, low unemployment rates, and improved investment returns.

“Low unemployment rate and steady investment income are the other macroeconomic factors that will aid life insurance growth over 2024 to 2028,” told Ampabathina.

Short-term growth will also be facilitated by rising premium rates due to inflation, while long-term growth will be supported by a changing regulatory environment.

Persistent inflation, which peaked at 7.8% in December 2022 before gradually decreasing to 4.9% in October 2023, is expected to reach the targeted 2% to 3% range in 2024 due to increased monetary tightening by the Reserve Bank of Australia (RBA).

This will stimulate higher consumer spending on life insurance. Additionally, the steady unemployment rate of 4% forecasted over the next five years will sustain consumer spending on insurance products.

ALSO READ: Australians strike out health insurance amid soaring costs

Interest rates take effect

Furthermore, higher interest rates have bolstered insurers’ capital positions, enabling them to manage the potential increase in premiums resulting from rising claims costs.

The Australian Prudential Regulation Authority (APRA) reported that the life insurance industry doubled its profits to $831.1m in the year ending 30 June 2023.

Demographically, Australia's ageing population will contribute to the demand for life insurance, with the percentage of people aged over 65 years expected to increase from 16.7% in 2023 to 18.6% in 2030.

Healthcare demand higher

Moreover, heightened healthcare awareness following the COVID-19 pandemic has driven an increase in private health insurance membership.

“Australian regulators have introduced multiple reforms in 2023 to bring the life insurance practices in line with international standards. This is expected to improve transparency and boost customer satisfaction and positively impact the life insurance industry over the coming years,” Ampabathina commented.

According to Private Healthcare Australia (PHA), membership in private health insurance grew by 2.3% in 2023, with approximately 55% of the Australian population now covered by private health insurance.

New standards

Implementing the Australian Accounting Standards Board 17 (AASB 17) and the Life Insurance Code of Practice (Life Code) on 1 July 2023, is expected to enhance transparency and customer trust in the industry.

AASB 17 ensures consistency in insurance contracts and prevents fraud and manipulation, while the Life Code governs customer relationships with insurers, mandating plain language in life insurance contracts and establishing guidelines for claim expectations and complaint mechanisms.

“Growing awareness of life and health insurance, decline in inflation, and steady premium pricing will support Australia’s life insurance growth over 2024-28. The regulatory reforms will further streamline the industry, paving the way for consistent long-term growth.” added Ampabathina.

Advertise

Advertise