Electric vehicles to drive motor insurance growth in South Korea

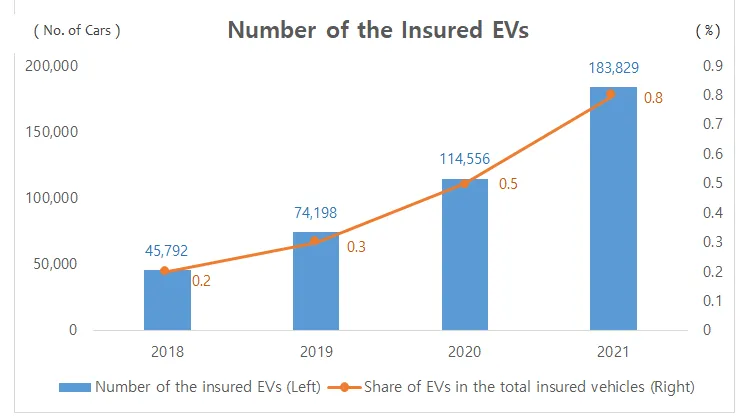

The number of insured EVs tripled from 2018 to 2021.

The increasing use of electric vehicles (EVs) has been driving the growth of the car insurance market for EVs in Korea, according to a report by Korean Re.

The number of insured EVs across the country more than tripled to around 184,000 at the end of 2021 compared to 2018. Korean Re said that although EVs still account for a very small portion (0.8%) of the entire motor insurance market, the share has been rising fast over the last few years.

“This growth trend is expected to accelerate as EV sales are soaring due to a combination of improvements in battery technology, growing consumer awareness of eco-friendly lifestyle, and the government’s carbon neutrality initiatives under which financial incentives such as tax credits and direct purchase subsidies are provided to promote the sales of EVs,” the insurer said.

In general, EVs cost more to insure mostly because their actual cash value is higher than their non-electric equivalents. On average, the actual cash value of EVs was 2.7 times as high as that of conventional vehicles in 2021. The average premium per personal car insurance policy for EVs in Korea was $698.50 (KRW943k) in 2021, much higher than $564.43 (KRW762k) for gas-powered vehicles. From 2018 to 2021, the average premium for EVs increased by 34.5% compared to an 11.2% rise for conventional vehicles.

The cost to repair or replace parts of EVs is higher than regular gas-powered motor vehicles, which accounts for higher premium rates for EVs. In 2021, repair costs of EVs under the own damage car insurance coverage is 30.2% higher than conventional cars.

The loss ratio of electric car insurance was 76% in 2021, down 21.4%p from 2018. The stabilization of the loss ratio was driven by increases in average premiums and the number of insured vehicles and a drop in loss incidence rate. Still, the insurance loss ratio of EVs remained 2%p higher than that of gas-powered automobiles in 2021. By coverage type, the own damage loss ratio of EVs fell significantly to 67.9% in 2021, 4.4%p lower than that of conventional vehicles, while the EV insurance coverage for bodily injury liability and property damage liability had loss ratios of 81.7% and 77.8%, respectively, which were still relatively high compared to non-electric cars.

“It has been a challenge for insurers to provide EV drivers with adequate insurance coverage at reasonable prices based on an accurate understanding of the nature and risks of EV technology, which is relatively new and rapidly evolving. In particular, a lack of sufficient underwriting data and experiences presents obstacles to insurers. At the same time, however, the rise of EVs will also bring new business opportunities to the insurance industry, and it will be thus important for the industry to develop and build underwriting expertise in keeping with how the mobility sector evolves,” Korean Re said.

Advertise

Advertise