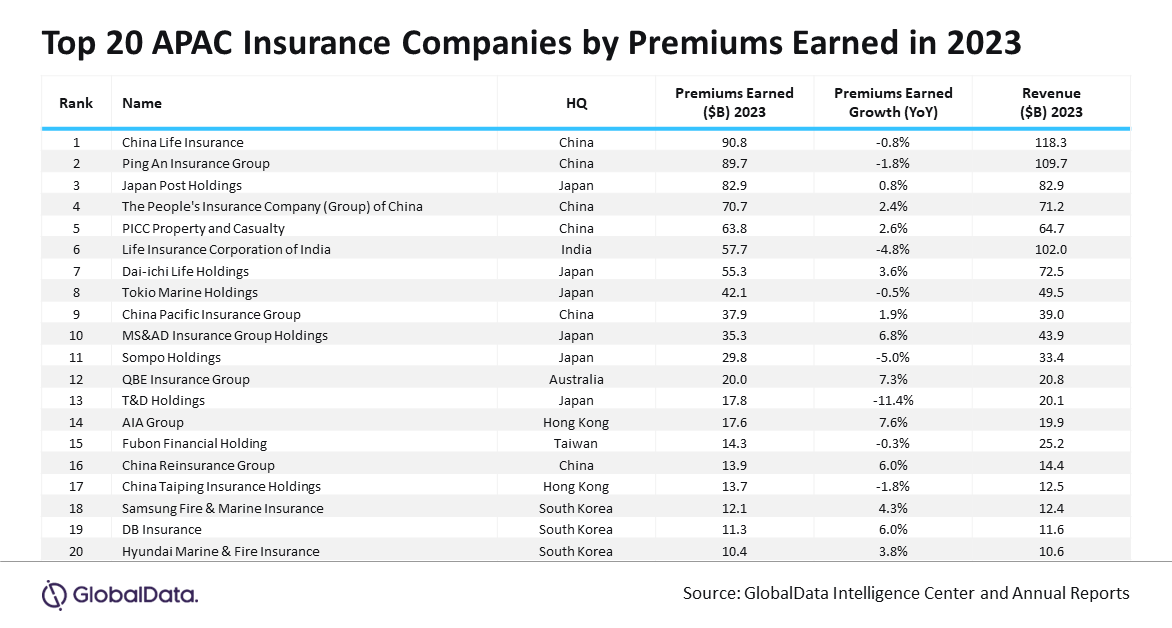

How did APAC insurers fare in 2023?

The average premium earned by these companies grew by just 1.3%.

Twenty of Asia Pacific’s (APAC) top public insurers reported subdued premium growth in 2023, primarily due to economic challenges and regulatory changes like inflation and the implementation of IFRS 17, according to data from GlobalData.

The average premium earned by these companies inched up 1.3%, whilst total revenue saw a modest 5.5% increase. "Premiums earned" refers to the portion of a policy premium collected by an insurer for the expired portion of the policy.

Murthy Grandhi, Company Profiles analyst at GlobalData, noted that IFRS 17 has complicated financial reporting and capital requirements for insurers, though it has also improved transparency, risk management, and comparability.

Amongst the top performers were AIA Group, QBE Insurance, and MS&AD Insurance Group, with 12 of the top 20 insurers showing year-on-year growth in earned premiums.

AIA Group experienced a 7.6% growth in premium earnings, largely due to a shift in its product mix toward long-term savings and increased bancassurance contributions in Mainland China.

QBE Insurance saw a 10.2% rise in revenue, driven by premium rate increases and targeted new business growth. However, this was partly offset by deliberate exits from property portfolios in North America and Australia.

MS&AD Insurance Group reported a 17.5% increase in revenue, fueled by growth in both Mitsui Sumitomo Insurance Co. and Mitsui Direct General Insurance, with premium rates rising by 4.2% and 2%, respectively.

On the other hand, T&D Holdings and Sompo Holdings saw declines in earned premiums by 11.4% and 5%, respectively, largely due to tightening underwriting standards, particularly in regions vulnerable to natural disasters.

“APAC region continues to grapple with economic uncertainties and evolving regulatory frameworks, insurers will need to maintain agility and a forward-looking approach to capitalise not only on growth opportunities arising out of retirement and health segments, but also on emerging risks from adoption of electric vehicles and cyber-attacks. Firms that can balance the demands of risk management with the pursuit of profitable growth, particularly in emerging markets, will be well-positioned to thrive in the years ahead,” Grandhi said.

Despite challenges, the industry remains optimistic about growth opportunities in the region, which still offers room for further market penetration, Grandhi noted.

Advertise

Advertise