Indian health insurance sector slated for 12.8% CAGR by 2028

The industry is also forecast to grow by 15% in 2024.

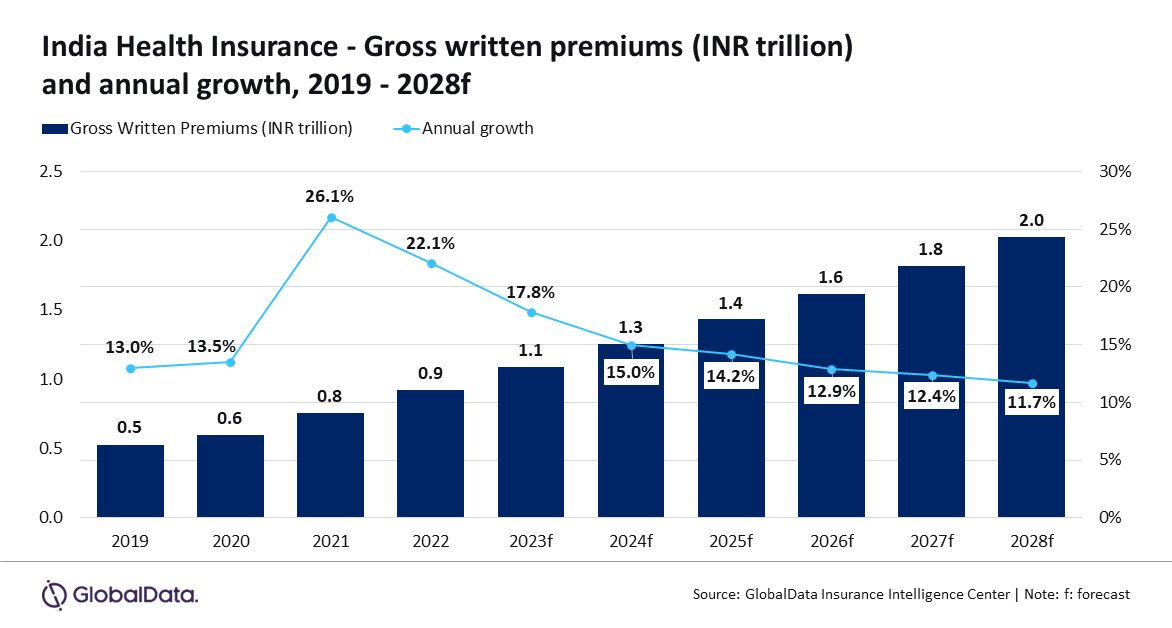

The health insurance industry in India is expected to grow at a compound annual growth rate (CAGR) of 12.8%, increasing from $15.1b in 2024 to $23.8b by 2028, according to GlobalData.

The share of health insurance in the Indian insurance market grew from 6.9% in 2019 to 9.5% in 2023, with a projection to reach 11.0% by 2028.

The industry is forecast to grow by 15% in 2024, driven by regulatory changes, medical inflation, and greater awareness of healthcare needs.

“The Indian health insurance industry has witnessed impressive growth since the onset of the COVID-19 pandemic. In 2023, it grew by 17.8%, driven by rising out-of-pocket expenditure towards healthcare, growing awareness of health insurance due to the increasing risk of lifestyle diseases, and easing insurance accessibility due to digitalisation. The trend is expected to continue in 2024 and 2025,” Sneha Verma, Insurance Analyst at GlobalData said.

Premium rates are rising due to increased demand for private healthcare, higher service costs, and technological advancements. These factors, along with regulatory reforms, will continue to drive growth in 2024.

Effective April 2024, the Insurance Regulatory and Development Authority of India (IRDAI) will remove the age cap of 65 for purchasing health insurance, encouraging higher-risk consumers to seek coverage.

Additionally, insurers can no longer deny policies to individuals with severe medical conditions, although they may reassess risk, which could lead to further premium increases.

Other regulatory changes include the introduction of a new healthcare regulator and composite insurance licences, potentially allowing insurers to offer life, general, and health insurance under one entity, attracting new market players.

Digitalisation is also playing a key role, with insurers leveraging AI and machine learning to enhance customer service, streamline underwriting, and detect fraud, all of which are improving operational efficiency.

“An increase in health awareness and rising premium rates will support the growth in the Indian health insurance industry over 2024-28. Positive regulatory reforms and initiatives by the government will help in improving the health insurance penetration rate in India (0.35%), which was lower as compared to other regional markets such as Taiwan (1.8%), Australia (0.93%), China (0.78%), and Hong Kong (0.67%) in 2023,” Verma added.

Advertise

Advertise