Indonesia’s insurance M&A to reach $22b in 2027: GlobalData

The increase in MCR for insurers is expected to lead to merger and acquisition (M&A) activities.

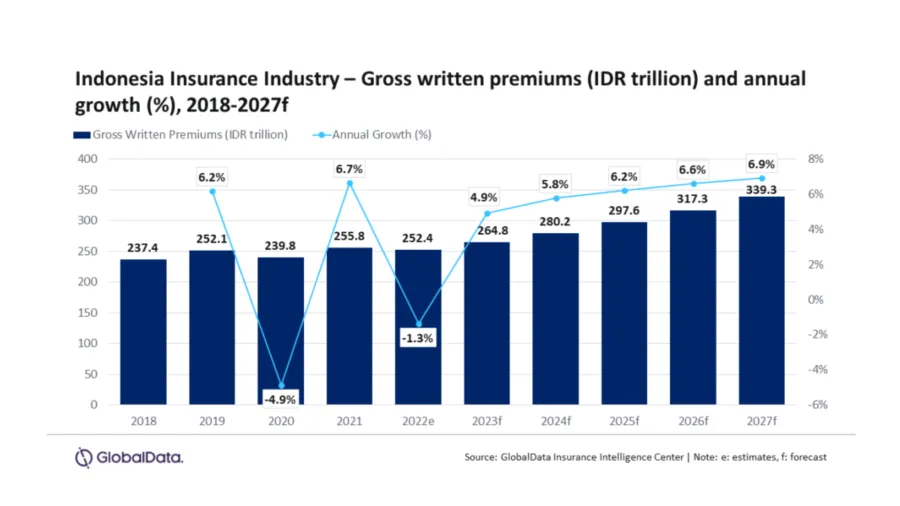

Indonesia’s significant increase in minimum capital requirement (MCR) for insurers is projected to drive a compound annual growth rate (CAGR) of 6.4% from $17b in 2023 to $22b in 2027, GlobalData said.

Indonesia's proposal to significantly increase the MCR for insurance and reinsurance companies is expected to boost merger and acquisition (M&A) activities, resulting in further consolidation of the country's insurance industry.

“The new regulation is also expected to result in the transfer and closure of businesses for insurers with lower revenue due to an inadequate capital structure. Furthermore, such high capital requirements will also act as an entry barrier for small insurtech players that are looking to disrupt the market. This will take smaller players out of the competition and help larger players with higher capital strengthen their capabilities through consolidation.” Shivani Kela, Insurance Analyst at GlobalData, said.

ALSO READ: Global M&A claims surge despite smaller deal volume: Report

The regulator, Otoritas Jasa Keuangan (OJK), proposed increasing the MCR for insurance companies from $10.4m to$34.6m in 2026 and further increasing it to $69.2m by 2028. Similarly, the MCR for reinsurers is set to increase from $20.8m to $69.2m in 2026 and $138.5m in 2028.

The new regulation is expected to result in the transfer and closure of businesses for insurers with lower revenue due to an inadequate capital structure, and smaller insurtech players may find it challenging to meet the new standards, potentially leading to consolidation in the market.

Advertise

Advertise