Will Gen AI caution worsen Singapore’s insurance talent crunch?

Regulatory expectations are pushing the industry to strengthen expertise risk management.

Singapore’s insurance industry is facing growing pressure from global uncertainty, tighter regulation and the rapid shift toward generative AI, with hiring demand remaining strong in underwriting, actuarial work, claims and compliance.

The wider digitalisation of the financial system is also increasing demand for cyber risk insurance, according to Randstad's 2026 job market outlook & salary guide report.

Insurers are looking for people who can combine technical knowledge with regulatory understanding to price, structure and manage coverage for intangible digital assets and liabilities.

Regulatory expectations are rising as well, pushing the industry to strengthen expertise in managing risks linked to system security threats, compliance gaps and legal liability.

In underwriting, employers are shifting expectations away from routine administration and toward higher-value risk judgement.

Underwriting managers are being pushed to expand into deeper work, including root-cause analysis of complaints, advanced modelling, and regular adjustments to underwriting standards and policy terms to match internal guidelines and changing customer needs.

Companies are also expecting underwriters to provide stronger market insight, including competitor positioning, with increasing focus on fraud risk management, regulatory compliance and underwriting profitability.

Employers are also seeking actuaries who can translate complex data into clear recommendations for senior stakeholders.

Hiring demand is focused on pricing strategy, financial modelling, business performance management and the ability to convert technical findings into risk metrics.

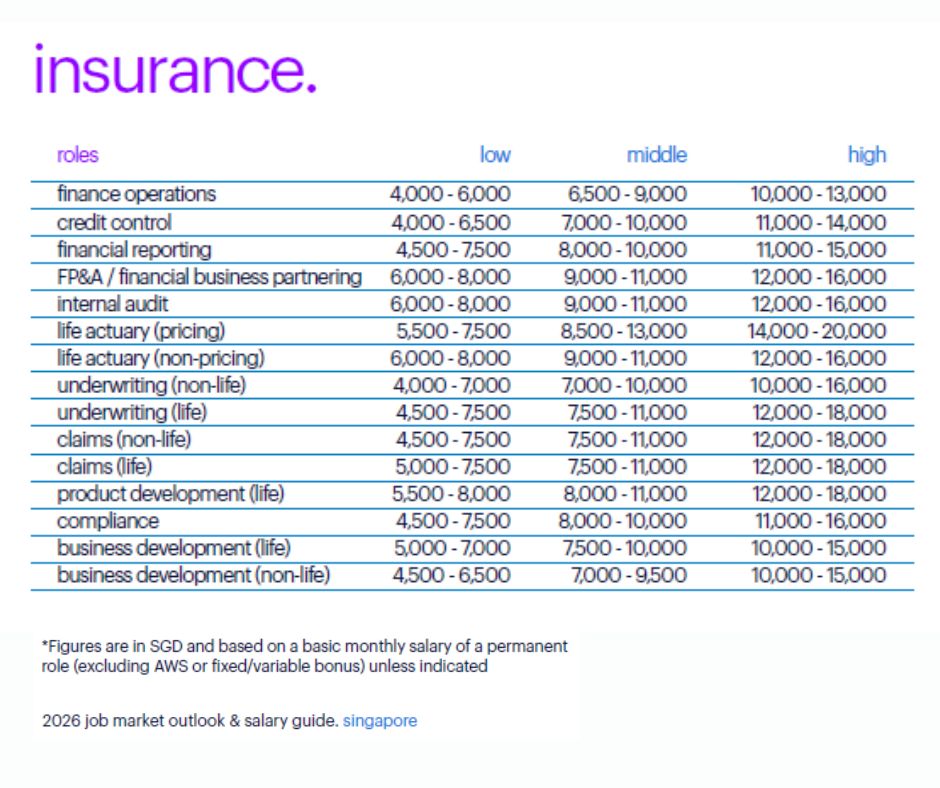

Salary data from Randstad reflects the competition for specialised skills, particularly in actuarial and underwriting roles.

Whilst there is general recognition across the sector that generative AI could reshape work, many insurers are still taking a cautious approach and delaying full adoption.

This is creating pressure to set clearer talent pathways so AI can be deployed safely and in line with regulatory expectations, especially as parts of the insurance sub-sector still have room to mature their Gen AI adoption.

Hiring remains robust, but insurers face a limited supply of candidates with highly specialised skills, particularly in underwriting and actuarial work.

At the same time, firms are increasingly being pushed to improve retention by offering clearer progression routes and more structured development, as a perceived lack of growth remains a key reason employees resign

Advertise

Advertise