60% of Indian policyholders caught in subscription traps

The Central Consumer Protection Authority (CCPA) identified 13 types of dark patterns.

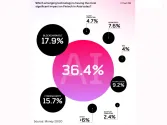

About six in 10 policyholders in India have experienced the “subscription trap”, where insurance platforms have made it difficult to cancel their plans.

Mis-selling of insurance policies is a common issue across various types, including life, health, motor, and property insurance, warmed LocalCircles. Agents often omit policy drawbacks or hard-sell policies to meet targets. Although consumers can cancel misleading policies, many trust agents fail to read the full document during the consideration period.

With the rise of online insurance purchases, complaints about mis-selling and manipulative selling (dark patterns) have increased on LocalCircles over the last nine months.

The survey received over 36,000 responses from insurance consumers in 309 districts of India, with 66% of respondents being men and 34% women.

Respondents were from tier 1 (49%), tier 2 (24%), and tier 3, 4, and rural districts (27%).

False urgency tricks consumers into thinking a product is available for a limited time, deterring them from reading all the information. Insurance websites often use pre-selected options and false hierarchies to guide consumer decisions. Thus, 86% reported nagging approaches when seeking quotes or attempting to cancel policies.

This uptick coincides with the Central Consumer Protection Authority's (CCPA) November 2023 prohibition on 13 types of dark patterns, such as false urgency, basket sneaking, confirm shaming, forced action, subscription traps, and more.

According to the CCPA, these dark patterns amount to misleading advertisements, unfair trade practices, or violations of consumer rights. For example, forced action makes consumers believe they must follow specific directions to get a quote, leading to unnecessary disclosure of personal information.

Forced action tactics were experienced by 57% of respondents, who were asked for unnecessary personal details, leading to unsolicited information or misuse of their data.

Advertise

Advertise