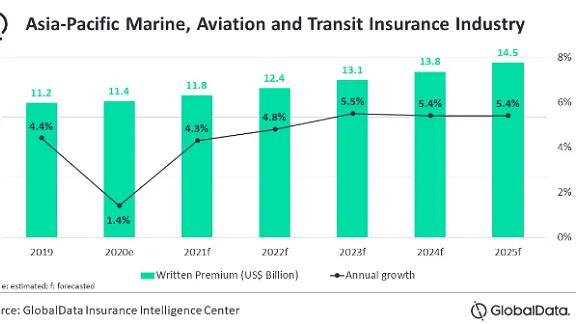

APAC MAT written premiums to hit $14.5b in 2025

The sector will grow at a CAGR of 4.4% from 2019 to 2025.

Asia’s marine, aviation, and transit (MAT) insurance written premiums are set to reach $14.5b in 2025 from $11.2b in 2019, according to a GlobalData report.

The sector will grow at a compound annual growth rate of 4.4% from 2019 to 2025. In terms of annual growth, the sector dropped an estimated 1.4% in 2020 but will recover to a forecasted 4.3% in 2021.

The decline in growth was caused by air travel restrictions, supply chain disruptions, and a weak economy, said GlobalData analyst Deblina Mitra. Japan and China collectively accounted for 60% of the region’s premiums in 2020.

China’s intricate presence in the global supply chain and its growing airline and marine fleet are strong growth drivers for insurers, the report said.

APAC has also seen several insurers withdrawing from the MAT industry due to years of unsustainable losses resulting from both man-made and natural hazards and bottomed out premium prices which resulted in reduced market capacity, the report added.

However, the impact on premium price increase due to these market exits were mostly offset by the entry of new players such as China-based Donghai Marine Insurance and the resurgence of Lloyd’s syndicate’s presence in the region.

“The enactment of new sulfur limits as per the International Maritime Organization ruling in 2020 is a development that aims to tackle global warming contributed by the maritime sector and is a focus area for insurers,” Mitra said.

The regulation mandates shipowners to make changes in ship parts and fuel to comply with the standards. This exposes insurers to high claim risk and can lead to an increase in prices, the report concluded.

Advertise

Advertise