Asia insurance industry logs lowest pricing increase in Q1

Insurance segments saw lower increase rate than the previous quarter.

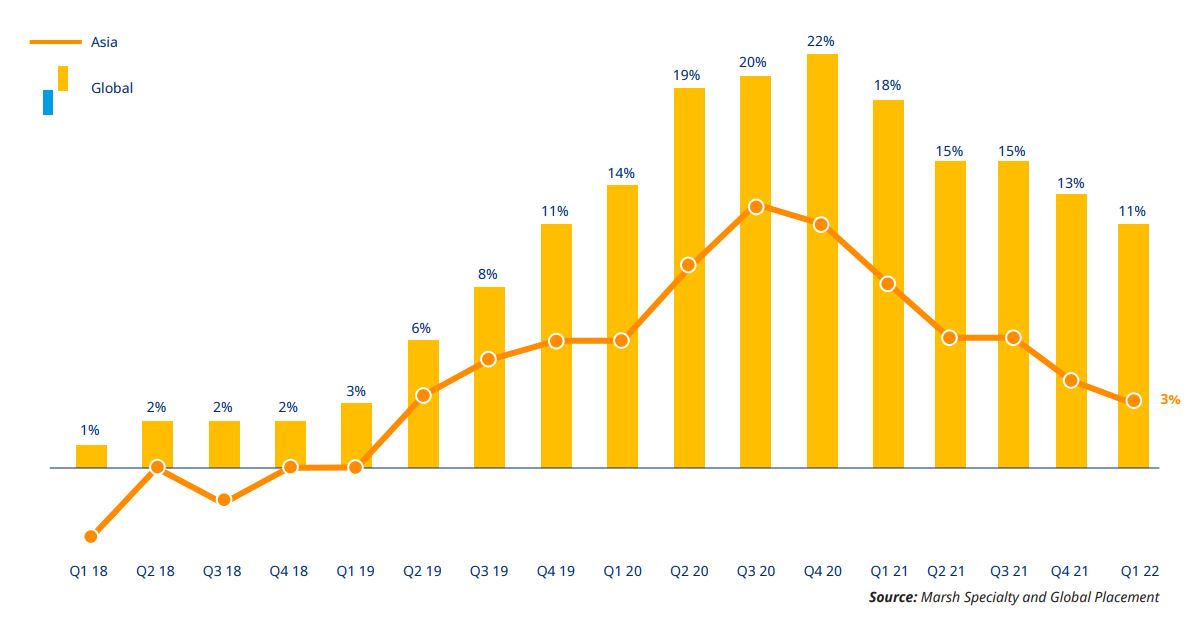

Asia logged the lowest pricing increase at 3% in the first quarter by region, with the pace of increase continuing to decline, according to Marsh’s Global Insurance Market Index Q1 2022.

By region, UK topped the list with a 20% increase followed by 12% in the US, 10% in the Pacific, and 6% for both Continental Europe and Latin America, and the Caribbean.

According to the report, price increases continued to moderate across segments. Property insurance pricing rose 2%, down from 3% in the fourth quarter of 2021. Marsh said that the market remained challenging for clients in CAT zones, high-hazard industries, and those with poor loss histories.

Meanwhile, casualty insurance pricing increased 2%, as it did in the fourth quarter of 2021 whilst financial and professional lines pricing increased 13%, down from 17% in the prior quarter.

In total, global commercial insurance prices rose 11% in Q1, marking the fifth consecutive reduction in rate increases since global pricing peaked at 22% in Q4 2020.

You may also like:

EXCLUSIVE: Why embedded insurance is cutting out the middleman

Malaysia general insurance industry to reach $5.5b in 2026

COMMENTARY: Hong Kong insurers step up to seize opportunities in Greater Bay Area

Advertise

Advertise