Asia still lags in insurtech amidst 169% growth in deal values

Deals in Asia-Pacific account for only 7% of the the global share.

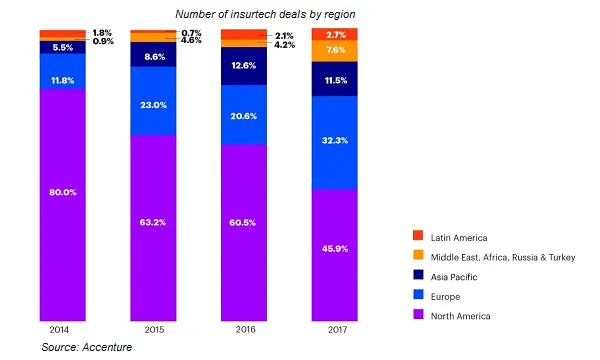

The insurtech trend continues to penetrate the insurance industry in Asia-Pacific, with investment in insurtech in the region surging by 169% in deal values to $358m in 2017, according to data and analysis by Accenture. Still, the actual share of insurtechs coming from the region remain low, with just over 100 recognised insurtech startups in Asia-Pacific, accounting for around only 7% of the global share.

Accenture noted that despite the growth in the number of insurtech deals in Asia-Pacific at 27%, behind Europe’s 118% growth in insurtech deals in 2017, the region’s insurtech ecosystem remains relatively small compared to other regions, particularly in North America and Europe, given that majority of the industry’s activities continue to predominantly centre in the financial and commercial districts of Singapore, Hong Kong, and China.

Manulife Asia, for instance, has taken the step forward towards integrating technological innovation in their operations by collaborating with fintechs and insurtechs to apply blockchain technology and develop artificial intelligence in its technology hub in Singapore.

“The insurtech industry’s rapid growth reflects investors’ response to consumer appetite for change in an industry sitting on trapped value,” said Roy Jubraj, Accenture’s UK and Ireland insurance strategy and innovation lead.

Meanwhile, other emerging markets including Malaysia, Indonesia, Thailand, and Vietnam are trying to catch up—both in policy and industrial interest—with regulatory provisions already in place to allow for the development and growth of local insurtechs, according to a report by Willis Towers Watson.

Property and casualty remain the most popular insurance segment for insurtech investments globally in 2017, accounting for about 42% of global investments, whilst life, health, and microinsurance have the most impact from digital propositions and insurtech.

Advertise

Advertise