Etiqa named official fire insurer for HDB flats

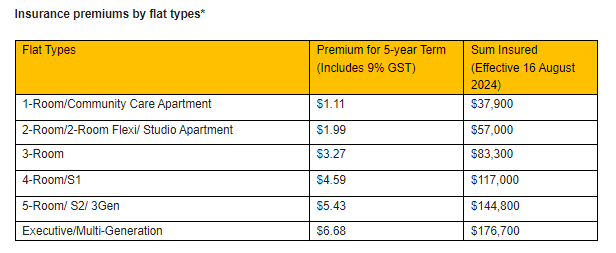

Insurance premiums range from US$0.84 to US$5.07.

Etiqa Insurance Singapore has been named the official fire insurer for the Housing and Development Board’s (HDB) Fire Insurance Scheme in Singapore.

Beginning 16 August, Etiqa will provide basic fire insurance coverage for all sold HDB flats.

The insurance premiums, ranging from US$0.84 (S$1.11) to US$5.07 (S$6.68) for a five-year term depending on the flat type, are designed to ensure that fire insurance remains affordable and accessible for all HDB flat owners.

Existing policies expiring after 15 August, will not be affected by this change.

The HDB Fire Insurance Scheme covers the costs of reinstating damaged internal structures, fixtures, and fittings provided by HDB, as well as repair works for damage to adjoining properties and water damage from burst pipes.

Raymond Ong, CEO of Etiqa Insurance Singapore, highlighted the importance of home security, stating, “As the appointed insurer for the HDB Fire Insurance Scheme, we are committed to delivering affordable and comprehensive fire insurance coverage and ensuring Singaporean homeowners have the peace of mind they deserve. This means financial protection for one’s home in case of fire damage to internal structures and fixtures provided by HDB.”

(US$1.00 = S$1.32)

Advertise

Advertise