GWP of Indonesian general insurers to hit $5.17b in 2025

The sector is expected to recover 2.9% in 2021.

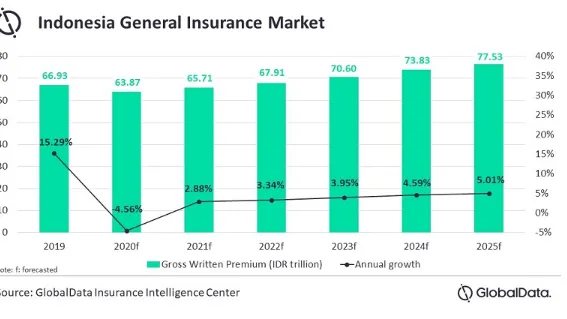

The gross written premiums (GWP) of Indonesia’s general insurers will likely reach $5.17b (IDR77.53t) in 2025, a GlobalData report projected, with the market expected to recover 2.9% in 2021.

Restricted commercial activities and lower domestic consumption led to a steep decline in demand for general insurance, with the most impacted being property lines, which declined 6.2% in 2020.

However, it is poised to benefit from investments in infrastructure, proposed as part of the government's economic reforms.

Credit insurance accounted for 21% of the total general insurance premiums in 2019, posting a CAGR of 72.1% between 2017 and 2019 due to increased awareness and implementation of the 2016 National Financial Inclusion Strategy, which expanded funding for small and medium-sized enterprises (SMEs) and micro SMEs. However, the economic volatility and heightened risk of bad debts could weigh on the sector in 2021.

Personal accident and health insurance (PA&H), which accounts for 8% of general insurance premiums, is forecasted to grow in 2021, backed by increase in awareness for health insurance products. As policies providing COVID-19 hospitalisation and telemedicine benefits gained traction, the category is expected to grow at a CAGR of 7.03% during 2021-2025 and partially mitigate decline from other business lines.

With many sectors opening up, incremental gains were reported across sectors in Q4 2020, indicating a rebound in the insurance industry as well.

“The proposed regulations permitting general insurance companies to issue PAYDI and unit-linked long-term general insurance products could usher in product innovations and help increase insurance penetration over the forecast period,” said analyst Rakesh Raj.

Advertise

Advertise