IAG affirms catastrophe reinsurance programme

About 17,000 claims were filed in December alone.

IAG established its catastrophe reinsurance programme for 2024 and updated its natural peril events from December 2023.

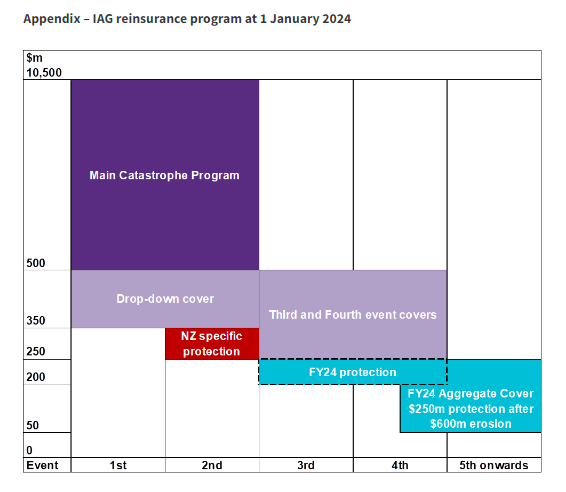

The 2024 Catastrophe Reinsurance Programme entails a main cover for two events up to AUS$10.5b, starting at AUS$500m. Also, an additional AUS$150m drop-down cover, reducing IAG’s retention to AUS$236m for the first two events. A specific second event cover is also available for New Zealand of AUS$100m, over AUS$250m. For events at a third and fourth time around, coverage each entails AUS$250m excess of AUS$250m.

For FY24, additional third and fourth event protection of AUS$150m for events over AUS$200m, and an aggregate cover of AUS$250m over AUS$600m, with per event cap at AUS$200m over AUS$50m.

CFO William McDonnell notes that global reinsurance markets stabilised in 2023, allowing IAG to secure better reinsurance protection at a cost aligning with their expectations. The reinsurance programme is aligned to 67.5% of IAG’s quota share arrangements, limiting IAG’s maximum event retention to AUS$236m.

ALSO READ: Natural catastrophes drive insured losses to record levels in 2023 – Swiss Re

December’s natural perils

Approximately 17,000 claims were filed in December, including 500 from ex-Tropical Cyclone Jasper and 9,000 from severe storms around Christmas.

IAG’s brands are providing on-ground support in affected areas.

CEO Nick Hawkins emphasises the focus on community and customer safety, with ongoing support for emergency assessments and repairs.

IAG’s maximum event retention in December 2023 was AUS$169m, with the total cost of claims still being assessed. Current natural perils costs are below the allocated allowance.

IAG will release its HY24 financial results on February 16, 2024.

Advertise

Advertise