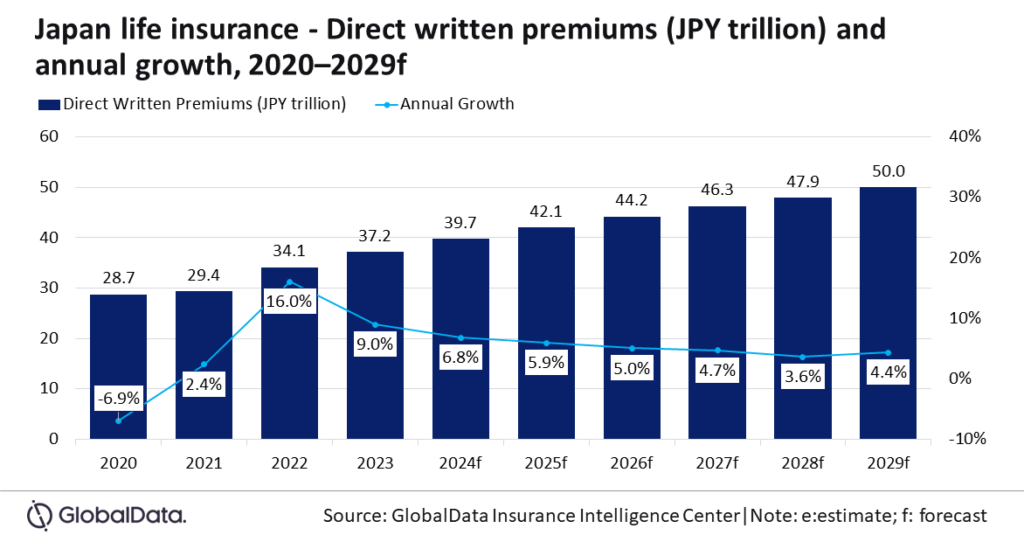

Japan’s life insurance slated for 4.7% CAGR through 2029

The industry is forecasted to expand by 6.8% in 2024.

The Japanese life insurance market is projected to record 4.7% compound annual growth rate (CAGR), with direct written premiums (DWP) expected to increase from $275.8b in 2024 to $371.2b by 2029, according to GlobalData.

Thanks to Japan’s economic recovery and rising domestic interest rates, which have bolstered demand for yen-denominated life insurance products.

The industry is forecasted to expand by 6.8% in 2024, fueled by rising consumer interest in single-premium yen-denominated products.

“Japan’s life insurance industry grew by 9.0% in 2023, driven by an increase in consumer interest towards yen-denominated single-premium insurance products as the Bank of Japan raised interest rates in March 2024, marking the first increase in the last 17 years,” Swetansha Chauhan, Insurance Analyst at GlobalData, said in a report.

“Although the Japanese economy declined by 2.9% during January-March 2024 as compared to the previous year, it is expected to rebound in the latter half of 2024, which will support the growth of life insurance,” Chauhan said.

Despite a 2.9% economic contraction in the first quarter of 2024, a recovery is anticipated later in the year, which will further drive life insurance demand.

Previously, foreign currency-denominated policies in US dollars and euros maintained stable sales due to a weak yen and higher overseas interest rates.

However, the Financial Services Agency (FSA) recently reported high cancellation rates, with 60% of these policies being terminated within four years as policyholders took profits early.

In response, some banks have reduced their offerings of foreign currency-denominated products, focusing instead on yen-based products.

Japan's ageing population is another significant driver, with those aged 65 and above comprising 29.1% of the population in 2023—a figure expected to reach 34.8% by 2040.

This demographic shift is fueling demand for life insurance and pension products, as more citizens plan for longer life expectancies.

Digital transformation is reshaping the industry, as insurers collaborate with tech firms to develop cost-effective digital sales channels, replacing traditional agent-based models.

Insurers are also using generative AI and wearable tech to enhance wellness-linked policies, which offer rewards for healthy activities.

“The life insurance market in Japan presents a positive outlook, driven by cost-effective digital distribution solutions and innovation in product offerings,” said Chauhan.

“However, interest rate fluctuations, declining birth rate, and global market volatility are expected to remain a focus area for the Japanese life insurers over the next five years,” Chauhan added.

Advertise

Advertise