Life insurance sector for India remains subdued, February sparks 48.4% premiums

Year-to-date, new business premiums of Indian life insurers narrowed their decline to 0.2%.

After robust growth in fiscal year 2023, first-year premium numbers of Indian life insurers in 2024 have shown a subdued movement overall. However, February witnessed a surge of 48.4% in first-year life insurance premiums compared to a decline of 16.8% in the same period last year.

Despite short-term fluctuations, the growth potential of the life insurance segment remains resilient, supported by favourable demographics, economic conditions, and regulatory frameworks.

The industry outlook remains positive for the longer term, with a focus on addressing the protection gap within the market and fostering industry development.

This increase was primarily driven by group single premiums, especially from the Lifce Insurance Council (LIC), and a strong performance by private insurers.

In the April to February period, new business premiums of life insurers narrowed their decline to 0.2% compared to 25.1% growth in the previous year.

ALSO READ: India's health insurance market to surpass US

The decline can be attributed to factors such as the introduction of a new tax regime, reduced single premiums, primarily from LIC, and the significant momentum experienced in March 2023.

Private insurance companies have maintained growth, albeit at a slower pace compared to the prior year. Most companies, including LIC, reported robust growth for February.

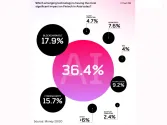

Whilst LIC recorded a 67.5% increase, private insurers collectively recorded a growth of 27.8%, significantly higher than the rate witnessed in February 2023.

For February, non-single premiums rose by 19.3%, while single premiums surged by 67.0%, primarily driven by LIC.

However, single premiums continued to fall for the year-to-date period but remained a substantial portion of the overall first-year premiums.

In February, group premiums surged by 79.2%, with the single premium segment contributing significantly to this increase. Meanwhile, individual premiums grew by 17.4%, higher than the growth rate of the previous year.

Advertise

Advertise