Married people have the most insurance literacy rate in Hong Kong; survey

They are followed by mature working adults, with the youth as the least literate.

The life stages of most Hong Kongers can also impact their insurance literacy rate, with married persons having the highest rate, a survey by the Insurance Authority revealed.

In 2021, the IA conducted the first Insurance Literacy Tracking Survey to understand the levels of insurance literacy amongst the general public in Hong Kong.

Riding on the findings of the ILTS, the IA also released the Lifetime Risk Profiling and Insurance Literacy Thematic Report which investigates differences in insurance literacy by life stages.

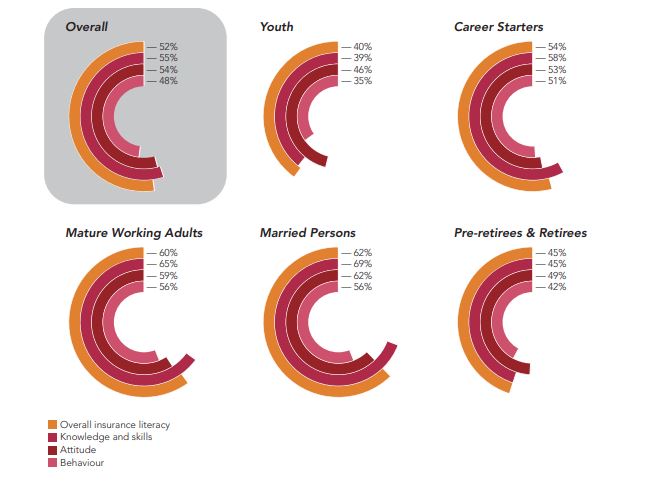

The five life stages defined in the ILTS are: Youth, Career Starters, Mature Working Adults, Married Persons, and Pre-retirees & Retirees

Married persons scored a 62% insurance literacy rate. In the three dimensions of the insurance literacy rate, married persons scored 69% in knowledge and skills, 62% for attitude, and 56% for behaviour.

They are followed by mature working adults, who scored a 60% insurance literacy rate. Those in the Career Starters life stage scored 54%

The Youth life stage showed the least literacy rate amongst the five life stages at 40% and Pre-Retirees at 45%.

“For Youth who are still receiving education and financial support from their family, it is understandably rare for them to think of future financial burdens. They will have little idea of their family’s current expenses, let alone their parents’ future needs. Life planning is also typically absent at this stage. Due to no sense of urgency, Youth may not see any obligation to understand insurance and thus will put no effort into it,” the IA said.

Advertise

Advertise