Yen products drive 13% revenue boost for Japanese insurers

Ordinary profits increased to US$22.40b.

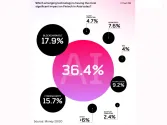

The premium income and other revenues of Japan's 42 life insurance companies rose 13.0% year-on-year (YoY) to US$301.00b (¥43.0t) in the fiscal year ended 31 March 2024. This was mainly driven by increased sales of yen-denominated single-payment products as interest rates in Japan began to rise, Toa Re’s Japan’s Insurance Market 2024 report stated.

Ordinary profits increased by 26.6% YoY to US$22.40b (¥3.2t), while basic profits, reflecting core business performance, grew 41.5% YoY to US$27.30b (¥3.9t). This improvement was largely due to a decrease in COVID-19-related hospitalisation benefit payments and the impact of higher interest rates.

Life insurers responded to the rise in profits by increasing dividends to both policyholders and shareholders.

Benefit payments related to COVID-19, which totalled approximately US$9.17b (¥1.31t) as of 30 September 2023, had significantly affected the industry. Special measures introduced during the pandemic accounted for around US$7.21b (¥1.03t) of those payments. These measures ended on 8 May 2023.

Despite its response to societal needs during the pandemic, the life insurance industry faced challenges, particularly a sharp decline in new policy sales due to restrictions on face-to-face sales and delays in digitalisation.

Additionally, some products created in response to COVID-19 were discontinued after a spike in deemed hospitalisation claims negatively impacted performance.

Meanwhile, competition in group credit life insurance is intensifying. These policies, which reduce a loan balance to zero if the policyholder dies or becomes severely disabled, are a standard requirement for large loans, such as mortgages.

Banks, unable to compete further on mortgage interest rates, are now differentiating group credit life insurance features. Insurance companies are adapting by offering more flexible policies, increasing non-medical upper limits, and providing additional services, such as living benefits for major illnesses and extended repayment periods, Toa Re said.

(US$1.00 = ¥142.56)

Advertise

Advertise