Pandemic, competitive rates drive NRI’s term insurance adoption

NRIs in high-income nations seek higher sums.

Non-resident Indians (NRIs) now account for 12% of all term insurance customers of online insurance platform Policybazaar, based on 2024 data.

This represents a 50% compound annual growth rate (CAGR) over a two-year period.

The COVID-19 pandemic, India’s economic growth, and the rise of digital platforms may have contributed to the higher take-up of term insurance amongst NRIs.

“As a fast-growing economy, India offers competitive premiums, making it an attractive destination for NRIs looking to safeguard their families back home. Additionally, the rise of digital platforms has simplified the purchasing process, allowing NRIs to buy policies remotely,” Policybazaar wrote.

Over 3 in 5 (61%) of buyers fall between 31-40. Female policyholders rose from 4% to 11%.

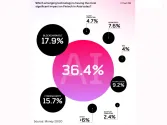

NRIs buying term insurance are most likely to be based in the UAE, the USA, Saudi Arabia, UK, Qatar, Oman, Singapore, Kuwait, and Australia.

NRIs in high-income nations, such as the US and UK, tend to seek higher sums assured due to higher living costs and income.

Advertise

Advertise