Olivia Tirona

Fukoku Life's solvency ratio expected to reach 300%

Fukoku Life's solvency ratio expected to reach 300%

Positive investment spread will continue to widen over the next 3-5 years.

Hollard Australia’s capital remains solid until 2026

It will also benefit from its acquisition of Commonwealth Insurance.

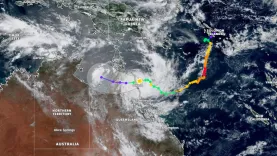

Japan's top insurers see mixed Q1 results amidst NatCat impacts

Jefferies warns to watch for potential natural catastrophes in Q2 2024.

Meritz Fire & Marine Insurance eyes MG Non-Life Insurance

Three entities are now bidding to acquire the non-life insurer.

Why AmMetLife CEO relies on digital to boost customer experience

The CEO coined four Cs to enhance customer experience.

Chubb makes chief appointments in finance team

Their roles are effective 4 September.

Sun Life Asia's Q2 2024 net income surges 24% YoY

The group’s EPS stood at $1.11.

Zurich Malaysia introduces first market complementary motorcycle warranty

It also includes breakdown towing service of up to 60 km.

SG's life insurance total weighted new business premiums surge 27% YoY in H1'24

Employment in the market was stable, a slight decrease of 0.5% versus last year.

Malayan adjusts portfolio to lower investment risks

The insurer is seen to have a five-year average ROE ratio of 3.8%.

Insurance market to hit $44.8b by 2032

APAC is the fastest-growing market for insurance analytics.

Sompo Holdings net income expands in Q1 2024

Net income per share stood at $0.83.

Dai-ichi Life’s Q1 2024 profit soars 41.1% YoY

Revenues inched up 0.52% YoY.

Generali’s net result dips 9% YoY in H1 2024

Adjusted earnings per share stood at €1.31.

Tourism surge leads to more uninsured patients at Japanese hospitals

Nearly 30% of visitors to Japan are uninsured.

Shin Kong Life sees solvency boost from parent company’s aid

Fitch expects SKL’s solvency position to stabilise further with an additional $0.43b.

Australian pension funds turn to catastrophe bonds for higher returns

Australia’s pensions industry brings over A$2b inflows weekly.

Advertise

Advertise

Commentary

How can insurers close protection gaps through customer-focused innovation?

AI isn’t replacing insurance, it’s finally making it work