Motor insurance growth slows down in Singapore

Higher taxes led to lower car sales in August.

The growth of Singapore’s motor insurance moderated to 2.7% due to a decline in motor vehicle sales, a report by data and analytics firm GlobalData revealed.

Though it still maintained its position as the largest general insurance line in Singapore, accounting for a 24.6% share of the gross written premiums (GWP) in 2021, significant costs to ownership of a new car like the increase of 15.2% in the cost of certificates entitlement (COE) contributed to a decline in vehicle sales.

ALSO READ: Japan raises health insurance premiums for high-income elderly

On the other hand, property insurance is expected to grow by 9.9% by the end of 2022 mainly due to increased construction activity in the country. According to the Building and Construction Authority (BCA), contracts worth up to SG$32b ($23b) are likely to be awarded in the sector in 2022. The projected demand for new infrastructure also indicates a positive picture which is expected to continue until 2028.

GlobalData also estimates that Personal accident and health (PA&H) insurance will be expected to grow at a compound annual growth rate (CAGR) of 7.5% from 2021 to 2026, driven by increased awareness of financial planning and protection.

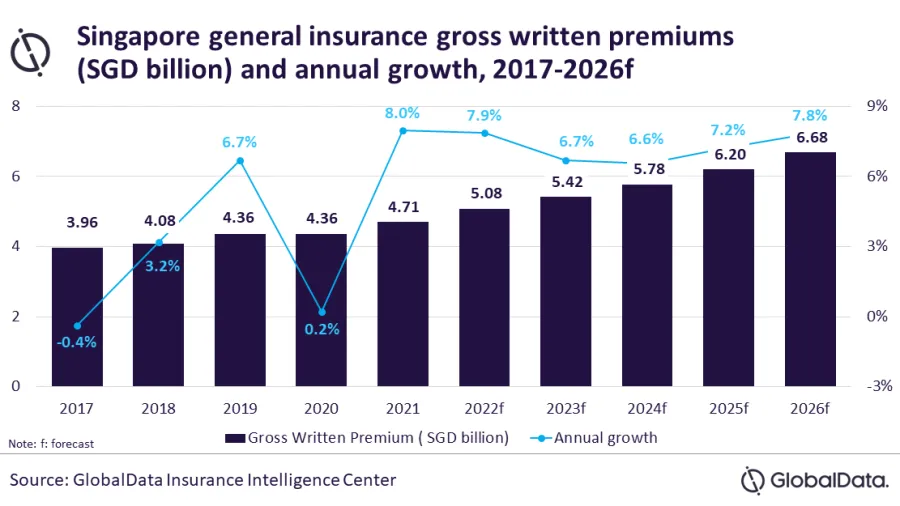

In total, GlobalData estimates that the general insurance industry in Singapore is set to grow at a CAGR of 7.2% from $3.5b in 2021 to $5.1b in 2026, in terms of GWP.

Advertise

Advertise