S.Korea insurance industry to see 4.7% jump in GWP in 2027

This is due to a regulatory proposal to deregulate digital insurance innovations.

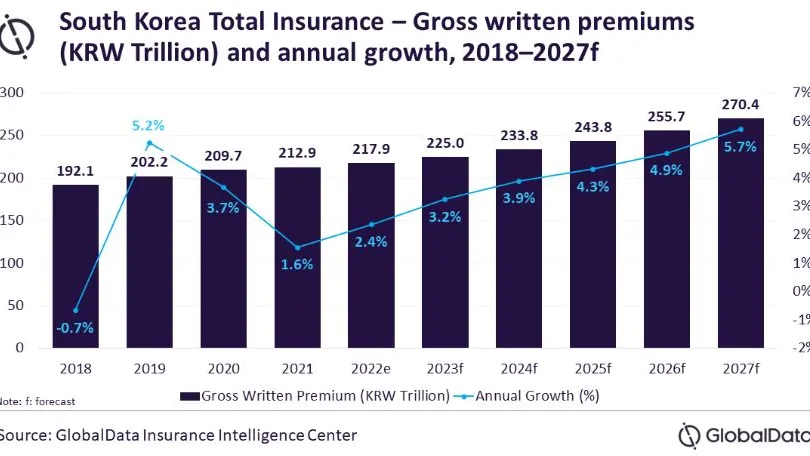

South Korea’s insurance industry expected a 4.7% compound annual growth rate, increasing the gross written premiums from ₩225t ($199.4b) in 2023 to ₩270.4t ($239.6b) in 2027, a report from GlobalData revealed.

GlobalData added that the expected growth rate is due to the country’s Financial Services Commission implementing its November 2022 proposal to deregulate digital innovations for new and incumbent insurers.

The proposal allows them to develop tech-related innovations in their existing and new online insurance products. GlobalData stated that this “will increase competition between neo-insurers and incumbents, resulting in the rollout of innovative materials.”

READ MORE: India's first-year premiums drop 16.8% YoY in February

For Sravani Ampabathina, GlobalData’s insurance analyst, the proposal “will further make it easy for insurtech companies to launch specialized and disruptive products.”

“The scenario is expected to change in the coming years with the FSC planning to deregulate life insurance’s online sales. In addition to the entry of neo-insurers into life insurance, expect existing life insurers to develop their online platforms,” Ampabathina said.

Ampabathina also expected a “huge boost” in life insurance’s online sales in South Korea as the proposed regulatory changes will attract online-focused neo-insurers.

Advertise

Advertise