How did marine insurance premiums fare in 2023?

Europe and Asia showed strong development in the cargo insurance market.

Asia Pacific’s (APAC) share of marine insurance premiums remained neutral at 28.1% ($10.9b) in 2023, versus the 28.4% in 2022, data from the International Union of Marine Insurance (IUMI) showed.

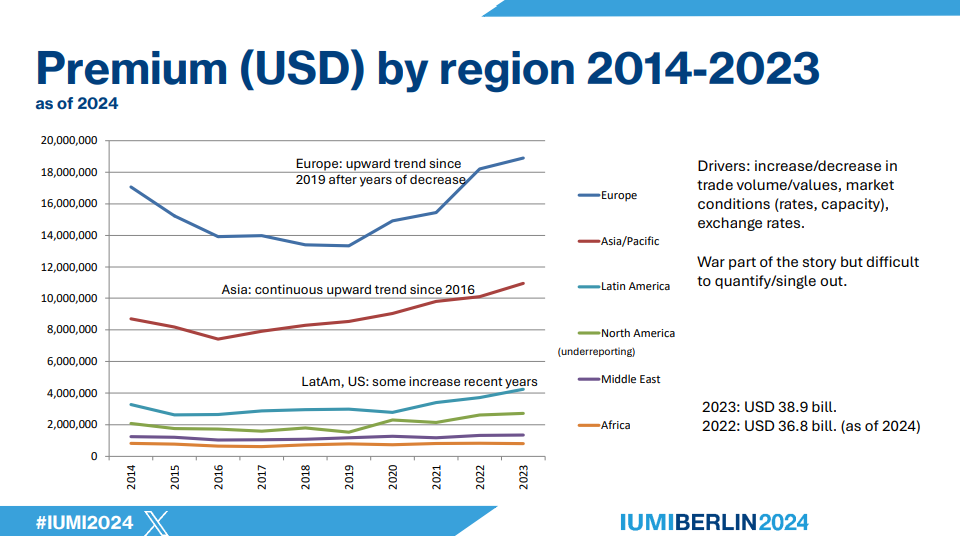

Global marine insurance premiums bagged $38.9b last year, which was 5.9% higher than the previous year. Growth was recorded across all business lines: Offshore Energy saw a 4.6% increase, Cargo insurance rose by 6.2%, and Ocean Hull by 7.6%.

Regionally, Europe dominated with a 48.5% share of global premiums. After APAC, Latin America (10.9%) and North America (7%) followed.

Cargo insurance maintained the largest share at 56.9% of total premiums, followed by Ocean Hull (23.6%), Offshore Energy (11.9%), and Marine Liability (7.7%).

Astrid Seltmann, Vice-Chair of IUMI’s Facts & Figures Committee, attributed the premium increases to global trade volumes, rising vessel values, and increased offshore energy activity. Whilst claims remained relatively low, major incidents like vessel fires and inflationary pressure on repair costs pose ongoing risks.

In the Offshore Energy sector, premiums reached $4.6b, driven by stable oil prices and increased activity. However, two major losses in 2023 have led to higher-than-usual loss ratios in Europe.

Cargo insurance saw a global premium base of $22.1b, up 6.2%. Premium growth followed the recovery in global trade post-COVID, with Europe and Asia showing strong development.

Despite fires and floods, loss ratios improved compared to previous years.

The Ocean Hull sector reported $9.2b in premiums, a 7.6% increase. Increased demand for vessels and higher vessel values contributed to the growth.

Claims frequency has risen post-COVID, with a noticeable increase in the cost of major losses, particularly from vessel fires.

Jun Lin, Chair of IUMI’s Facts & Figures Committee, stated that despite inflation and geopolitical tensions, 2023 was a positive year for marine underwriters.

However, challenges such as climate change, zero-carbon fuel technology, and cyber risks are expected to impact the industry moving forward.

Advertise

Advertise