How digital insurer Blue is revolutionising Hong Kong’s stagnant insurance industry

For CEO Charles Hung, one way to break free of the misconceptions about insurance is through gamification.

Hong Kong may be one of Asia’s prized financial centres, yet digital penetration of services in some financial sectors remains low. The insurance sector is one of them. Despite being seen as a mature market, digital penetration in the sector is less than 2%.

And that is just the tip of the iceberg. Hong Kong’s insurance industry also suffers from complex products, complex language, a really complex experience, and in many cases, even poor customer satisfaction.

“Very often in terms of products, you see so many new product innovations, but the consumer doesn't really have access to all the choices,” Charles Hung, CEO of Blue, Hong Kong’s first digital life insurer, told Insurance Asia in an exclusive interview.

“In general, the digital adoption in Hong Kong is low, not just for the insurance industry, but even for other online services such as online shopping, digital wallet usage. It is relatively low compared to the other locations, and perhaps compared to other industries, as well,” Hung added.

Hung recognised these pain points; you could even say he is an expert at it. Before becoming chief executive of the digital insurer, Hung spent 30 years working a variety of senior roles in different financial industries, occupying CIO, CSO, and chief executive roles in the banking, insurance, and asset management industries. He has also worked in a plethora of markets, not just in Hong Kong, but also in the US, Japan, and China. His background has given him extensive knowledge about the problems the insurance sector faces—and prepared him for the ambitious task of leading an enterprise set on revolutionising the insurance industry.

Because Blue is going big or going none: they plan to leave their mark by upturning misconceptions about insurance, providing simple, flexible, tech-savvy products to their customers.

Insurance Asia caught up with Hung to learn more about Hong Kong’s first digital insurer, as well as their plans to revolutionise Hong Kong’s insurance industry.

As Hong Kong’s first digital insurer, how has Blue made use of technology in order to create a seamless customer journey?

Technology is really is the driving force of our entire business model. We leverage a lot of technology, the ABCD. First in “A,” artificial intelligence (AI). We use a lot of AIs in the journey that we provide to our customers. For example, If you apply facial recognition technology to help in the identification journey, this would really enhance the customer experience.

We are also the first insurer in Hong Kong to adopt Tencent’s cloud technology. This is a very important part of our core infrastructure in terms of dealing with increasing capacities, performance, and speed. We have a very good cloud infrastructure to help us to support our customers. Specifically, this is helping us in Blue to deal with scalability issues and other challenges, because we do have a very good infrastructure in place.

Then for the C and D, that’s cloud and data analytics. We use a lot of data to analyze the market needs and the customer needs. In terms of just market customer data, we use a lot to improve both our underwriting process and the user experience, as well.

Blue is a joint venture between Hillhouse and Tencent. What inspired these two entities to team up and launch a digital-only insurer in Hong Kong?

I'll say that there are really two parts to that: first, it's about the market pain points and also about the low penetration rate. The insurance industry has been lagging behind in the financial industry in terms of digital penetration. Overall, the market has less than a 2% penetration from a digital perspective—way, way behind other sectors in the financial industry.

Our shareholders have the capability to house fantastic and very strong investment capabilities. Tencent is of course very strong in terms of technologies and also in the area of the internet. The combination of these two factors gives us the strong ability to address the needs of the market.

Our shareholders do see the market opportunity and coupled with their capabilities, I think there's a huge opportunity that we can capture. That, I would say, is the driving force: inspiring them, our shareholders, to invest in this particular area of insurance and to disrupt the market.

What are some experiences and challenges Blue faced when it first debuted in Hong Kong—and how did you and the company overcome these challenges? Any key lessons learned?

That is a very good question. First, I think earlier I discussed the market pain points. The truth is, addressing those market pain points is challenging.

There are additional challenges, too. For example, the customers’ perception of insurance in general. In general, people fear insurance and think that it’s incredibly complicated: some products are pushed to them, it always requires having an agent, or it is very expensive. There's quite a lot of negative feelings about the industry, and that's something that is really difficult to change.

Establishing the trust level, the credibility level, is the biggest challenge. Insurance is about trust, and building that trust from scratch, or from a start-up, is not straightforward; it takes time. Sometimes it takes experience, as well. So all those I would say are the main challenges that I see as Hong Kong’s first digital player trying to disrupt the market.

So how do we actually address them? First, when we consider the market pain points, what we, at Blue, need to do—and in fact, this is our vision—is to provide simple, flexible, and valuable solutions to our consumers. We are empowering our consumers to take charge of their own insurance needs.

What we have done is focus on three different areas. The first thing that we do is focus on product innovation.

On the product side, there are the traditional products with their really complicated underwriting processes. Sometimes you just want to buy [an insurance] product, but the underwriting process is too difficult and even sometimes prevents somebody from actually completing the purchase journey. So on that note, we have been designing very simple products, utilizing very simple language and simple terms that are easy to understand, with no excessive benefits offered that we know the consumers don't really need. So that is one area that we have been focusing on: product innovation by providing simple and flexible products.

I probably have not highlighted the issues on flexibility. That’s one pain point we have addressed. Our products, for the most part, are really flexible. You can adjust the term life of your policy, you can adjust the sum, anytime during the term of the product. We recognize that, sometimes, you might have changes in your life that also change your insurance needs.

The second one is marketing innovation. We don't have a physical branch or an agency, so how do we actually interact with our consumers? We use digital marketing, and we use a lot of data.

When you think about it, traditional insurance doesn't engage with the customer a lot. When they engage, it’s only when you probably want to buy something. When they reach out to you, they want to sell you something.

At Blue, we use a lot of gamification; we like to engage our customers through games. We produce a lot of educational videos, as well. We try to educate the consumer about the importance of insurance. Also, through that way, we increase awareness. Sometimes, we partner with KOLs through various social media platforms to really improve or enhance our reach to our customers.

Lastly, our focus has been on customer experience. You really have to make the customer feel that the experience we provide through digital tools can be just as good as when there is somebody next to you or even better than when there is an agent next to you. So the overall user experience, the overall journey experience from the point that they see our brand and interact with us has to be superb, has to be user friendly, has to be straightforward, has to be very simple, has to be very caring.

Demographic-wise, which age group or generation makes up the biggest share of your customer base? What does this age group expect from digital insurers?

So far, our core customer base ranges from 25 to 45. I would say that they probably make up over 55% of our customers. We also have other age groups, as well, but the 25 to 45 has been our core segment. The 25 to 35 age segment will be buying products that are less heavy on premium, whilst the 35 to 45 age group are more mature and financially capable. So, they will be buying more high-end products and more high premium products. That has been in line with our expectations. Knowing this is how we have been involved to really meet our customers’ needs.

If you go back to what I said, we consider price ability and value for our customers. That's the overarching theme, principle, and vision in what we do. As we evolve, we react to the market, as well. I think often my people, whenever we come up with a product, we always ask that question, “Is this product addressing the market? Is this product addressing a customer’s needs right?” If not, we should not be launching.

Blue recently launched the mobile app “Blue WeMedi” alongside a new top-up plan, WeMedi Top Up. How does the launch of the app refine your customers’ insurance and health journey?

The WeMedi app is particularly designed to help our customers manage their outpatient services from their mobile phones anytime. I would say that this new app really highlights our commitment to creating a fantastic customer experience and maybe even customer-centric insurance solutions by providing greater convenience and providing really flexible features.

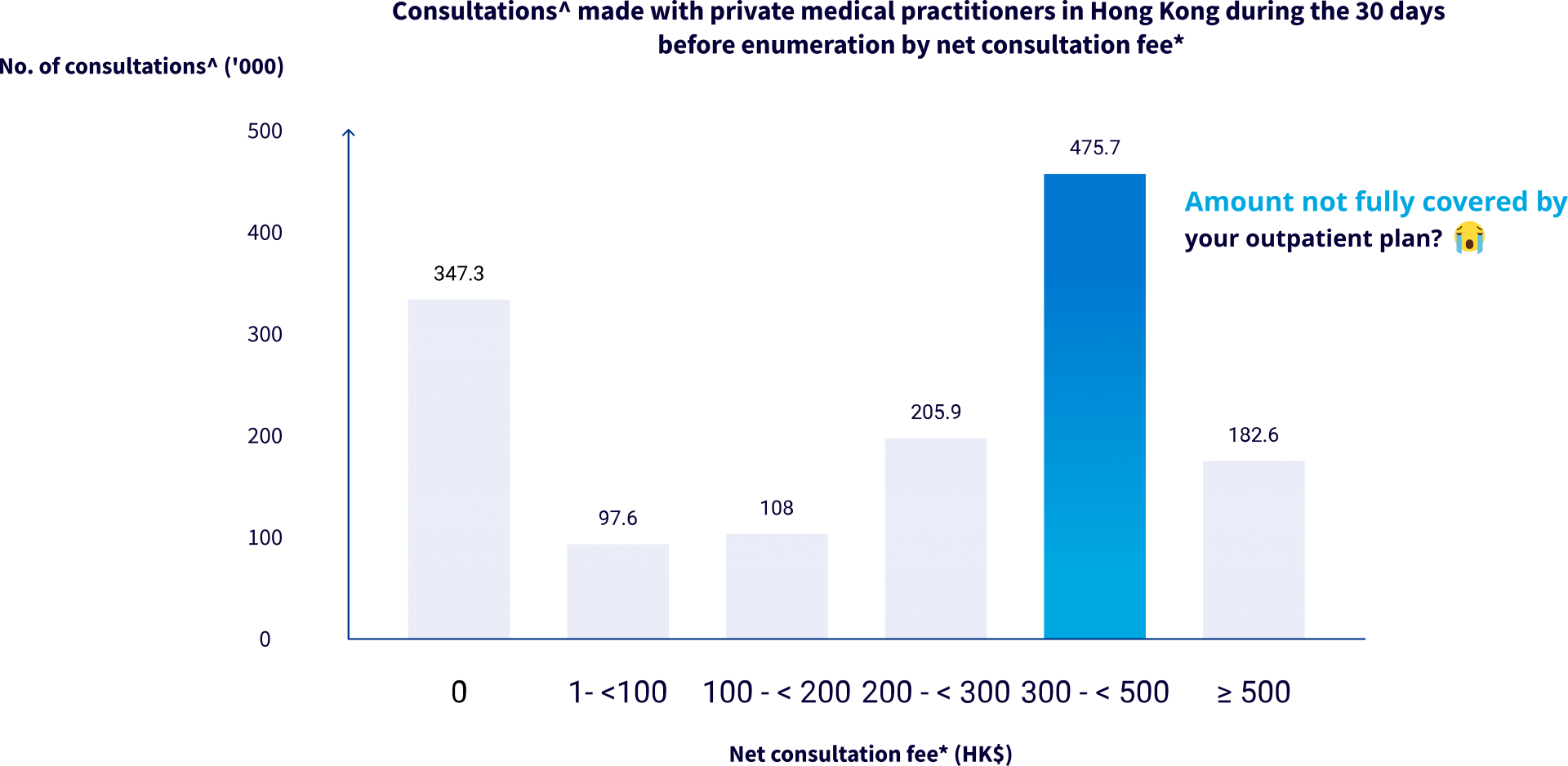

In general, a Hong Kong patient has to pay on average HK$260 net consultation fee excess for the outpatient service per visit - which could add up to thousands of dollars per year. (Source: Blue)

Let me highlight some of the features of this app. The WeMedi outpatient app is transparent in terms of details available to the consumer. You don’t need to flip your policy booklets anymore, it's in your mobile app. It's always with you anytime. For example, when you go see a doctor, you want to find out what's covered and what's not by your insurance. Here, you just read it on the app. There's also a search function, where you can search the nearby network doctors. Sometimes you might find yourself having an emergency, and you can plan when and where to visit. This mobile app also gives you an e-medical card, so you don't have to carry the card with you all the time. I personally always forget to bring my medical card, so this is convenient. It also reduces the size of your wallet.

I also mentioned the lack of engagement, the lack of information. We want to utilise this app to communicate with our customers. Through this app, we will be providing the latest updates and also special offers we have.

What are some trends you have observed in Hong Kong’s insurance space? How has this affected the digital insurance space?

With the COVID situation, people have become increasingly health-conscious. Therefore, in terms of demand for health products and insurance products, we're certainly seeing an increase in that. Second, during COVID, people have been doing social distancing, and so more people have been doing online purchases.

Hence, digital transactions have been more welcomed by the customers. There has been an increasing adoption of that. As a result, insurance companies have been accelerating their plans to digitise their platforms and their services. A lot of people are now investing more in those areas. All these things have been translating to heavy adoption of technology in the industry, the ABCD dimension; certainly, there's an acceleration and heavier adoption of that too.

The consumers have been a lot more demanding, as well. A lot more demanding from a product perspective, from a service perspective, and also from an experience perspective. I think traditionally, the products being offered are all the same: "Here's the menu, please choose from it." Now consumers are demanding a lot more—they want more tailored services. They want you to know them a little more before you make a recommendation.

All these really translate to the consumer wanting to take the driver’s seat. I think the industry, historically, has been insurance company-driven. The insurance company drives the products, drives the experience, we drive most of the stuff. Increasingly we're seeing the consumer wanting to take the driver's seat. They request more, they ask for better service. So, those are interesting trends that will make all of us think about how we're going to capture the opportunity.

What is your outlook for Hong Kong’s insurance sector?

The innovation of insurance services and products need to be accelerated and will be accelerated. You're seeing that insurers are now competing in terms of the speed of launching new services, trying to impress the consumers. That's number one: increasing innovation, increasing personalized services as technology becomes more advanced, basic acceleration of digital adoption, some of those things become possible.

The second one really involves the adoption of technology, in particular in the AI area. These days, we need to learn and understand a lot more about our consumers. So the usage of data is going to be a big topic for the industry. The usage of AI technology is going to be a big topic as well. Having said that, as technology becomes more advanced and digitisation is accelerating, that brings the challenge of cyber security, as well. I think cybersecurity is going to be an area of higher focus going forward.

Could you share with us a sneak peek of your future plans and goals? What can customers expect to see from Blue over the next year?

That's the 10 million dollar question! First of all, let me go back to the vision of Blue and also the meaning of Blue. Why do we call ourselves Blue?

The first core meaning of Blue is about the blue ocean. Blue is not interested in the red ocean, we are interested in exploring the blue ocean. So we're not interested in the existing crowded market, we want to dig into the new market. The blue ocean strategy has been one of our core strategies.

The second is about the blue sky. We raise innovation, and we believe that sky's the limit. I talked a lot about innovation earlier. That's what Blue is all about. So the blue-sky thinking is what we asked everybody to have in the team.

The third blue, I kind of gave it away before. I mentioned that we like to empower customers to be in charge of their own insurance blueprint so that they will be able to support themselves using the tools that we actually provide to them, they will have choices. Again, to be in charge of their own insurance blueprint is the third blue.

Finally, the fourth blue refers to the blue earth. Why blue earth? We care about our next generation, we care about the earth. We care about ensuring that we do our share in terms of helping the next generation create a better environment. So we participate in ESG programmes and even partner with NGOs in driving this goal.

Ultimately, our goal is to innovate insurance solutions together with our customers. Certainly, we want to be the leading digital insurance in the region, and we want to reshape the insurance landscape. Therefore, what's our plan? Again, our plan has three focuses: product innovation, marketing innovation, and customer innovation. We will continue to innovate our insurance products and solutions, and we won't change that direction.

Advertise

Advertise