Chinese life insurance set for 9% annual growth, to reach $893b by 2028: GlobalData

Increased awareness of health and better financial planning are a few of the growth drivers of China’s life insurance sector.

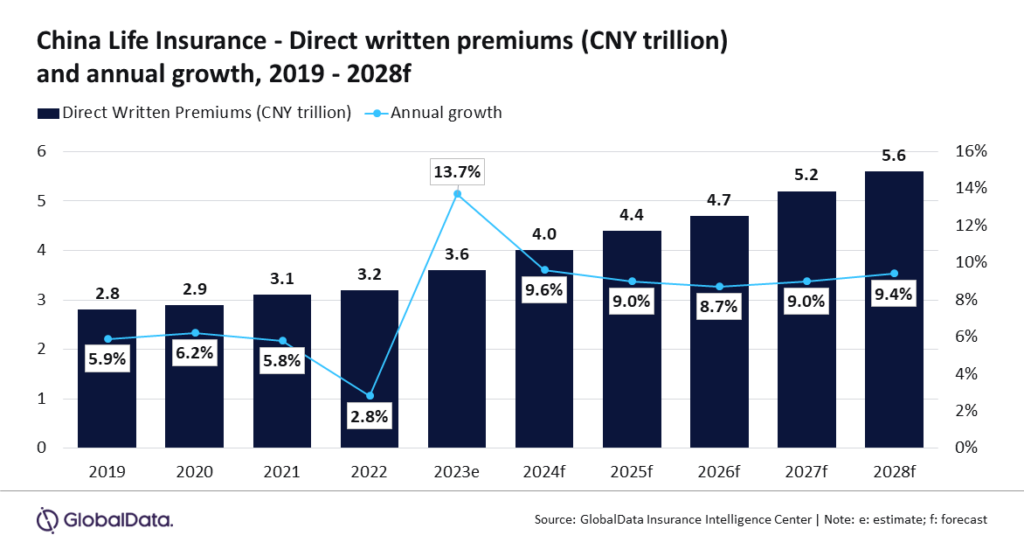

The Chinese life insurance industry is projected to experience a compound annual growth rate (CAGR) of 9.0% from 2024 to 2028, increasing from $597.1b to $893.2b in terms of direct written premiums (DWP), as reported by GlobalData.

“After witnessing a slower growth of 2.8% in 2022, the Chinese life insurance industry is expected to witness a double-digit growth of 13.7% in 2023, driven by economic recovery and the relaxation of the zero COVID policy in December 2022, which has helped in increasing the employment rate and household disposable income,” Manogna Vangari, Insurance Analyst at GlobalData said in a release.

The growth is expected to be driven by economic recovery, favourable regulatory developments, and increased awareness of health and financial planning following the pandemic.

Whole life insurance, constituting 78.3% of the life insurance DWP in 2023, is anticipated to lead growth, supported by an ageing population and a rising number of high-net-worth individuals.

ALSO READ: AM Best addresses concerns on China's economic slowdown, highlights insurer financial security

Personal accident and health (PA&H) insurance, the second-largest line, is forecasted to grow at a CAGR of 4.8% during 2024-28, driven by heightened health awareness post-pandemic and an ageing population.

“Rising health insurance premiums due to an increase in the medical inflation rate will also support PA&H insurance growth. A higher rate of acute diseases, a rapidly ageing population, and strong healthcare utilisation is leading to an increase in healthcare premiums in China. Additionally, government initiatives aimed at extending health insurance benefits to a larger population will also aid PA&H insurance growth,” added Vangari.

Regulatory initiatives, such as expanding personal income tax incentives and the launch of an individual private pension scheme, are also contributing to the industry's growth.

“China is projected to become a super-aging society by 2030, which will continue to create the demand for life insurance products. A growing affluent population, increasing awareness of health and financial protection, and positive regulatory developments will support life insurance growth in the country over the next five years.” concluded Vangari.

Advertise

Advertise