Malaysia motor insurance premiums hit $3.3b by 2030

Lower borrowing costs are also expected to support vehicle purchases.

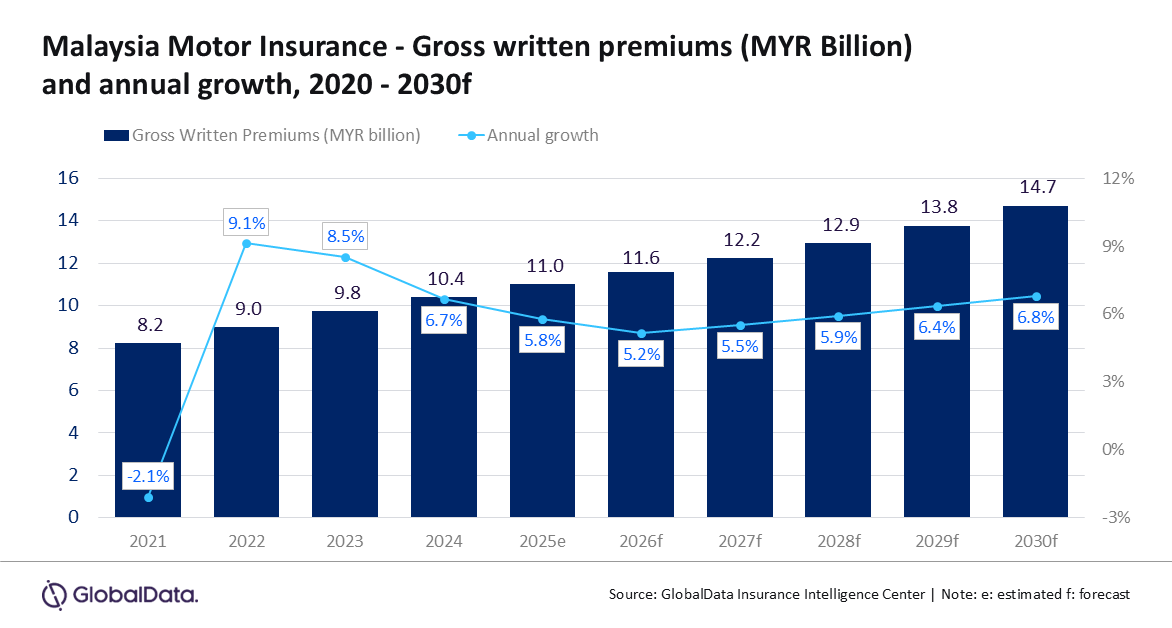

Malaysia’s motor insurance market is expected to grow at a compound annual growth rate of 6.0%, with gross written premiums rising from $2.5b in 2025 to $3.3b by 2030, according to data from GlobalData.

The industry is forecast to expand by 5.8% in 2025, supported mainly by the motor hull segment, which is projected to grow by 6.4%, compared with 4.2% growth in motor vehicle liability.

GlobalData said higher vehicle sales and an improving economy are driving premium growth, although rising claims are weighing on underwriting performance.

Motor vehicle sales exceeded 800,000 units in 2024, up 2.1% from a year earlier, based on figures from the Malaysian Automotive Association (MAA).

The association expects sales to pick up in the second half of 2025 despite a weaker first half, supporting continued demand for motor insurance through to 2030.

Lower borrowing costs are also expected to support vehicle purchases.

Malaysia’s benchmark interest rate was cut by 25 basis points to 2.75% in July 2025, after holding steady at 3% since May 2023, providing a more favourable environment for car loans.

Electric vehicle sales are also contributing to market growth.

Battery electric vehicles accounted for 8.6% of total vehicle sales in the first half of 2025, driven by government subsidies and tax exemptions on imported EVs.

Insurers are responding by offering products tailored to EVs, including battery coverage and access to specialised repair networks.

At the same time, profitability remains under pressure. The motor insurance loss ratio rose from 63.2% in 2020 to 68.6% in 2024.

Natural disasters, including floods between November 2024 and January 2025 and the Putra Heights fire in April 2025, alongside a rising traffic accident rate, are expected to push claims higher in 2025.

Average daily traffic accidents increased to 1,748 in 2024 from 1,644 in 2023, according to the Bukit Aman Traffic Investigation and Enforcement Department.

Insurers are increasingly adopting digital tools to manage policies and claims.

Platforms that allow customers to access policy details, submit claims, track roadside assistance, and renew coverage in one app are helping to improve efficiency.

Automation has also shortened claims notification and processing times, reducing costs for insurers.

GlobalData said the outlook for Malaysia’s motor insurance market remains positive, but high claims from accidents and natural disasters will continue to challenge profitability over the medium term.

Advertise

Advertise