Philippine life insurance sector slated for 5.4% CAGR by 2028

The industry will likely increase by 3% this year.

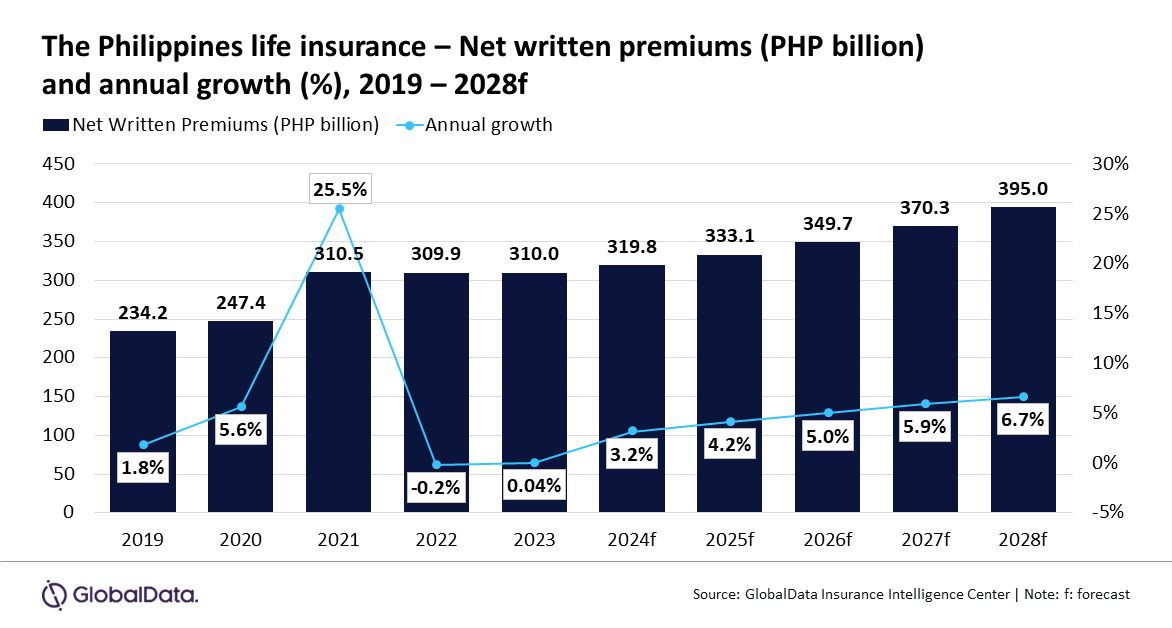

The Philippine life insurance industry is projected to accumulate $5.8b in 2024 to $7.1b by 2028 in net written premiums, according to GlobalData. This is equivalent to a compound annual growth rate (CAGR) of 5.4%.

GlobalData reports that the sector is expected to grow by 3% in 2024, driven by economic recovery and an ageing population with increasing life expectancy.

The share of Filipinos aged 65 and above is forecast to rise from 5.4% in 2023 to 6.1% by 2028, boosting demand for life insurance and pension products.

The Philippines' real GDP grew by 5.6% in 2023, with further growth projected at 6.1% in 2024 and 6.3% in 2025. This economic growth, along with a strong labour market and recovery in tourism and financial services, will support the life insurance industry, according to Prasanth Katam, Insurance Analyst at GlobalData.

Foreign currency-denominated life insurance products, especially in US dollars, have become popular amongst Filipinos due to potential currency appreciation and higher interest rates compared to peso-denominated investments.

“Insurers in the Philippines have responded to this demand by introducing investment-linked life insurance policies denominated in US dollars, providing customers with the opportunity to invest in foreign currency whilst enjoying insurance benefits,” said Katam.

Regulatory developments are also contributing to growth. In April 2024, the Cebu provincial government launched the Sugbo Segurado plan, providing accident and life insurance for government officials and employees in Cebu.

Additionally, the Philippines is considering easing regulations for Overseas Filipino Workers (OFWs), allowing them easier access to life insurance.

“The outlook for the life insurance industry in the Philippines is positive, driven by demographic trends, favourable regulatory developments, and the increasing adoption of technology. However, catering to the insurance demands of an aging population will be a focus area for insurers over the next five years,” concluded Katam.

Advertise

Advertise