Thailand’s life and health insurance industry to surge to $36.1b in 2026

The industry is growing at a CAGR 4.7%.

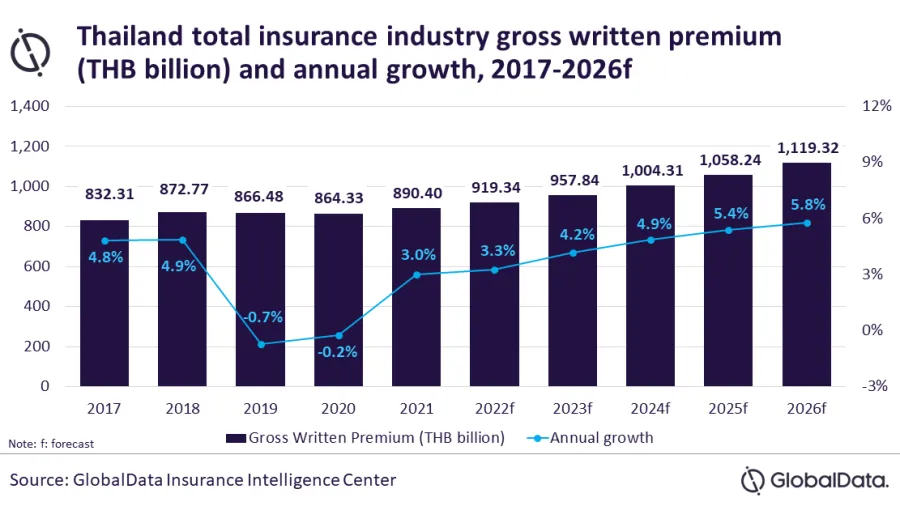

Thailand’s insurance industry is predicted to grow at a compound annual growth rate of 4.7% to $36.1b in 2026, data and analytics firm GlobalData revealed.

According to its report, the country’s total insurance industry growth will be led by the life and pension insurance segment, which accounted for a 69.3% share of the gross written premiums (GWP) in 2021.

“Thailand’s insurance industry grew by 3.0% in 2021 after declining by 0.2% in 2020 due to the COVID-19-related economic slowdown. The industry is poised for an upward growth trend from 2022, driven by economic recovery, increased health awareness, and the country’s aging population, which is supporting the demand for life and health insurance products,” Senior Insurance Analyst at GlobalData Rakesh Raj said.

READ MORE: Thai Life raises $1b in IPO

Raj said that Thailand is considered as one of the rapidly aging societies in the world. In 2021, almost 20% of its population was 60 years or above. This is expected to increase to 26.6% by 2030, which will support the growth of life and health insurance products over the coming years.

General insurance accounted for the remaining 30.7% share in the insurance industry GWP in 2021. The segment is expected to grow at a CAGR of 5.7% over 2021 to 2026, driven by the increase in vehicle sales and a strong pipeline of construction projects.

According to the Federation of Thai Industries (FTI), automobile production in the country recorded a 12.9% year-on-year increase in April 2022 due to higher demand. Automobile sales are expected to further improve with the recovery in global automobile semiconductor chip supply.

ALSO READ: India’s life insurance industry experiencing post pandemic growth: analyst

Raj also said that increasing government investments in infrastructure development will also support the growth of general insurance in Thailand over the next few years. Notable developments include the approval for a smart city project at a cost of $37b and Kathu-Patong elevated expressway project with a cost of $440m.

“Thailand’s total insurance penetration of 5.5% in 2021 was higher than the penetration in emerging markets like China (4.4%), India (4.1%), Indonesia (1.5%), Vietnam (3.3%), and the Philippines (1.7%). The popularity of life insurance products, aging population and innovation in the product offering are expected to drive the Thailand insurance industry growth over the next five years,” Raj said.

Advertise

Advertise