India’s life insurance industry experiencing post pandemic growth: analyst

It is set to grow to $150.6b in 2026.

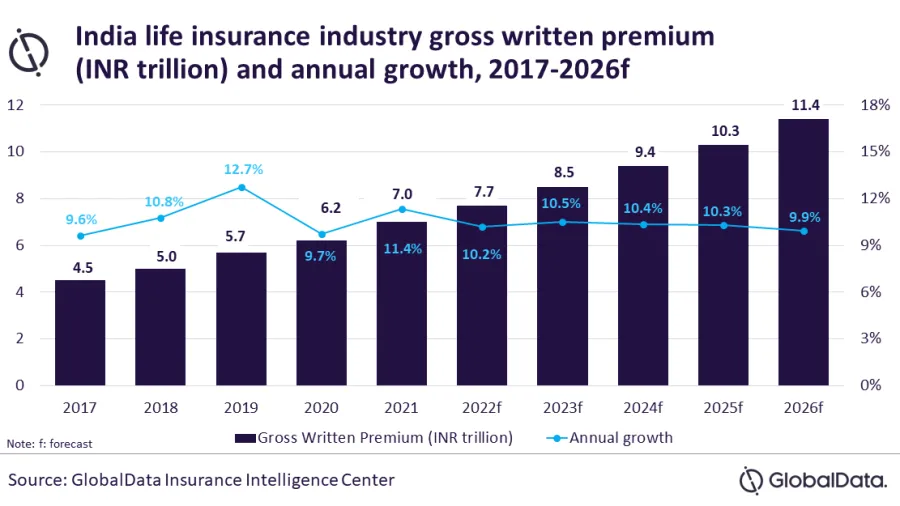

India’s life insurance industry is set to grow at a compound annual growth rate (CAGR) of 10.3% to $150.6b in 2026 as it experiences significant post-pandemic growth according to GlobalData insurance analyst Anjuli Shrivastava.

The growth is supported by growing insurance awareness, increasing demand for group policies, and a favourable regulatory environment. Furthermore, the life insurance industry is set to grow by 10.2% in 2022 driven by the development of digital distribution channels and product innovation.

Shrivastava said that during the last few years, Indian life insurers have witnessed strong growth in the sales of group life insurance policies. The Life Insurance Corporation of India (LIC), the largest life insurer in the country, with a 63.2% market share, recorded 12.7% growth in group life premiums in FY2021 whilst individual life premiums declined by 2.8%.

READ MORE: India general insurance industry doubles growth rate in 2022

“Private insurers are also increasingly offering group life policies as an employee benefit. Such policies, where the risk pool is diverse leading to lower premiums, are cost-effective employee retention measures,” Shrivastava.

The government’s push to increase life insurance penetration by selling life products to low-income customers through Pradhan Mantri Jeevan Jyoti Bima Yojana has also supported the growth of life insurance in India.

Positive regulatory developments have supported product innovation in the life insurance industry. For example, IRDAI relaxed product approval with the expansion of the ‘Use and File’ process to include life products. Earlier, under the ‘File and Use’ policy, life products required regulatory approval before their launch.

“India’s life insurance industry is forecast to witness double-digit growth over the next five years, twice the global average of 5.5%. The government’s initiatives to increase penetration, positive regulatory developments, and growing awareness will support the uptake of life policies,” Shrivastava concludes.

Another report said that by 2032, India is set to become the sixth largest insurance market in the world.

Advertise

Advertise