Vietnam's general insurance to hit $3.9b by 2028

Motor insurance holds the third-largest share in 2023’s GWP.

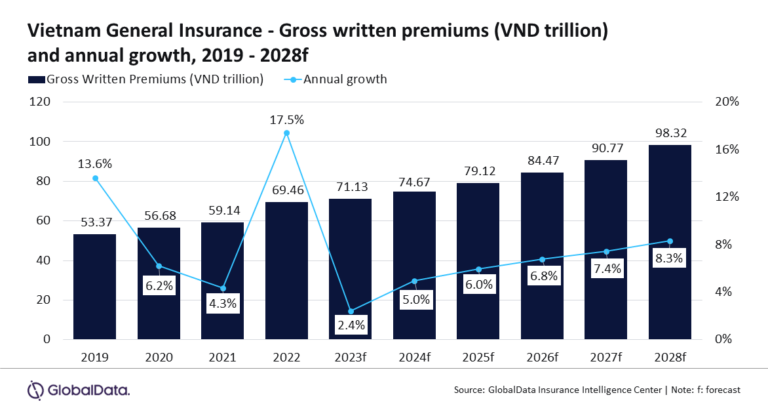

The Vietnamese general insurance industry is poised for steady growth, with a projected compound annual growth rate (CAGR) of 6.7% from 2023 to 2028, reaching $3.9b in gross written premiums (GWP) by 2028.

This growth is driven by various factors, including regulatory reforms, increased demand for natural catastrophic (Nat-cat) insurance due to climate change, and a post-COVID-19 rise in the demand for health insurance.

“After experiencing a significant growth of 17.5% in 2022, the general insurance industry is projected to achieve slower growth in 2023 due to a slowdown in Vietnam’s economy, which is expected to impact all major general insurance lines,” Swetansha Chauhan, Insurance Analyst at GlobalData said in a media release.

However, the industry should rebound from 2024 beyond amidst a recovering global economy and easing inflationary pressures.

In 2023, the industry is expected to grow by 2.4%, followed by a 5% growth in 2024. Personal Accident and Health (PA&H) insurance leads the market, accounting for a 35.0% share of GWP in 2023.

“The increasing cost of medical treatments, driven by a high demand for quality healthcare and rising inflation, has led to an increase in the premium prices for health insurance policies. Also, concerns about declining public health infrastructure, with long waiting periods and limited coverage have led people to move towards private health insurance, which will support PA&H insurance growth. PA&H insurance is expected to grow at a CAGR of 7.5% during 2023-28,” Chauhan said.

ALSO READ: Vietnam's insurance premium revenue dips 4.3% in Q1

The segment grew by 3.2% in 2023, fueled by rising health awareness post-pandemic and demographic changes, such as increasing life expectancy and an ageing population.

Property Insurance follows closely, making up a 25.6% share of general insurance GWP in 2023. It is anticipated to grow by 3.2% in 2023, driven by the heightened demand for nat-cat insurance policies due to frequent extreme weather events.

The construction sector's growth, expected to be 11.4% in 2024, further supports property insurance growth.

Motor insurance holds the third-largest share, accounting for 25.2% of general insurance GWP in 2023. However, it experienced a 2% decline in 2023 due to decreased vehicle sales.

The country's participation in the ASEAN Compulsory Motor Insurance System (ACMI) in November 2023 is expected to bolster the demand for motor insurance.

Liability, Financial lines, Marine, Aviation, and Transit (MAT), and Miscellaneous insurance make up the remaining 14.2% of general insurance GWP in 2023.

As the Vietnamese economy continues to grow and evolve, these segments are also likely to see growth opportunities.

“The general insurance industry in Vietnam is expected to regain its growth momentum in 2024, propelled by the global economic recovery. A stable socio-political environment, changing demographics, and increased health awareness due to the pandemic will support general insurance growth in Vietnam over the next five years.” concluded Chauhan.

Advertise

Advertise