What will drive Australia’s PA&H industry to reach $27.8b premiums in 2028?

The market is projected to expand by 5.9% in 2024.

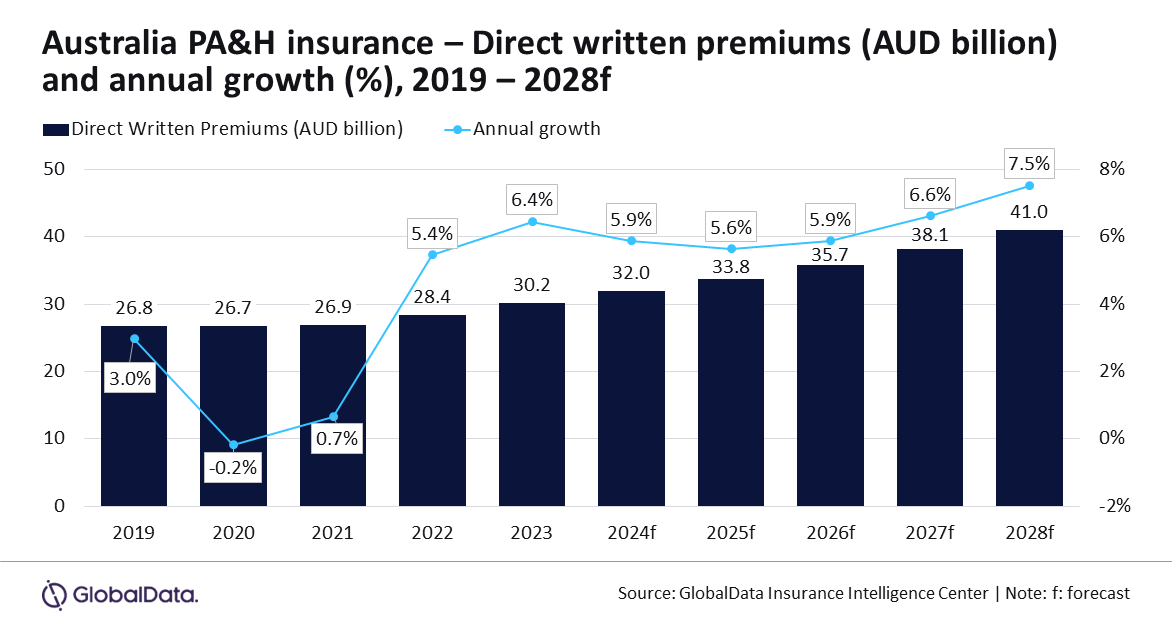

Australia’s personal accident and health (PA&H) insurance industry is set to expand significantly, with GlobalData forecasting a compound annual growth rate (CAGR) of 6.4% from $22.1b in 2024 to $27.8b in 2028 in terms of direct written premiums (DWP).

In 2024, the PA&H insurance industry is expected to grow by 5.9%, driven by several factors.

The COVID-19 pandemic has heightened health awareness, increased healthcare costs, and shifted demographics, notably an ageing population, which has boosted demand for private health insurance (PHI).

“Australia’s PA&H insurance industry continued its growth momentum from 2022 and grew by 6.4% in 2023, registering the highest growth in the last five years. The growth can be attributed to an increase in the membership of private health insurance. The trend is expected to continue in 2024,” Prasanth Katam, Insurance Analyst at GlobalData said in a release.

Australians have increasingly opted for voluntary PHI policies due to their comprehensive coverage, timely access to treatments, and flexible care options.

Private Healthcare Australia (PHA) reports that 55.1% of Australians had private health insurance as of November 2023, with the number of policyholders reaching 14.7 million, a 2.3% increase from November 2022.

In 2023, there was a notable rise in demand for hospital treatment coverage, particularly among young families and children under five.

According to the Australian Prudential Regulation Authority (APRA), PHI membership for individuals aged 40-44 increased by 7,298, and children aged 0-4 saw a membership increase of 24,407 in the quarter ending December 31, 2023, compared to the previous quarter.

“Changes in the country’s demographic factors such as the aging population as well as a rise in chronic diseases such as diabetes and heart diseases will increase the demand for health insurance, supporting PA&H insurance growth,” Katam added.

The Australian Bureau of Statistics (ABS) reports that 49.9% of Australians had at least one chronic condition in 2022, with 20% having two or more chronic conditions. A significant 80% of Australians with chronic conditions are aged 65 and over.

Alongside growing healthcare demand, insurers are grappling with increasing claims costs due to rising inflation.

Consequently, insurers are reevaluating their risk exposures and raising health insurance premiums, which is expected to bolster PA&H insurance growth in the short term. The government approved an average 3.03% increase in PHI premiums effective April 1, 2024.

“The rising healthcare costs are putting pressure on premiums, which will make people selective while purchasing health insurance. However, the increased premiums are not expected to have a significant negative impact on the growth of the Australian PA&H industry over the next five years.” concluded Katam.

Advertise

Advertise