APAC life segment records highest growth rate in over five years in 2021

Life insurance premiums in the region reached a record-breaking $1.3t.

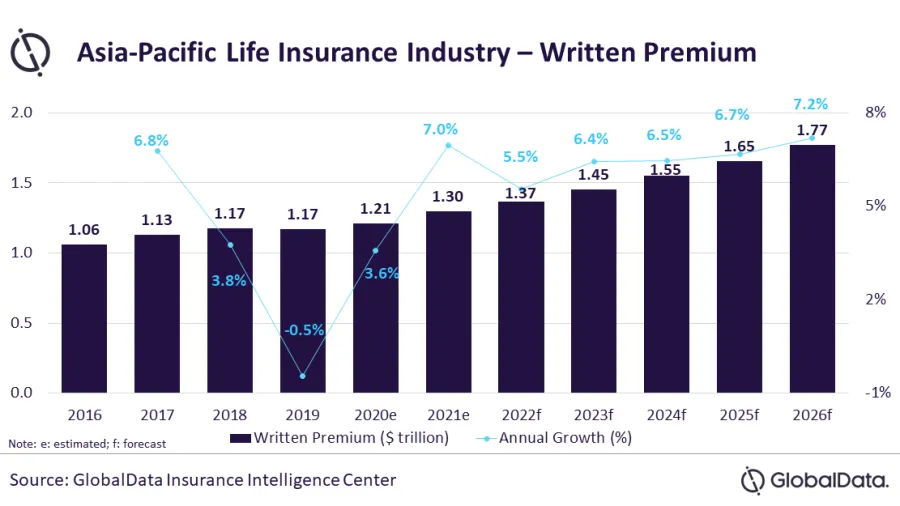

The Asia Pacific’s life insurance industry recorded the highest growth rate in over five years in 2021 at 7%, according to data and analytics firm GlobalData.

GlobalData revealed that this was due to increased insurance awareness as macroeconomic imbalances highlighted the importance of financial security in the wake of the COVID-19 pandemic.

In its report, GlobalData predicted that premiums in the life insurance industry in the region are expected to grow at a compound annual growth rate (CAGR) of 6.5% from 2021 to 2026, with premiums growing from $1.3t in 2021 to 1.77t in 2026.

“Despite the economic challenges in 2020, the life insurance industry bounced back as the COVID-19 pandemic highlighted the importance of life insurance for financial security. The industry’s growth doubled in 2021 aided by the economic recovery,” GlobalData senior insurance analyst Deblina Mitra said.

China, Japan, Taiwan, South Korea, and India were the top five regional markets, accounting for 85% of the region’s consolidated written premiums in 2021. China and India were the major growth drivers with double-digit growth in 2021 and are expected to maintain a CAGR above 7% from 2021 to 2026.

Meanwhile, Japan, Taiwan, and South Korea are expected to record a CAGR of 4.7%, 3.8%, and 3.1%, respectively, over the next five years from 2021.

“The life insurance industry in the Asia-Pacific region is expected to maintain steady growth over the next five years, driven by its underpenetrated emerging markets, improvement in the standard of living, and increased insurance awareness. Furthermore, the industry will see major insurtech developments to address demographic challenges and provide personalized insurance,” Mitra said.

You may also like:

India extends ‘Use and File’ system

Monument Re acquires Zurich Singapore’s life business

IN FOCUS: How did Hong Kong’s insurance industry fare in its first quarter?

Advertise

Advertise