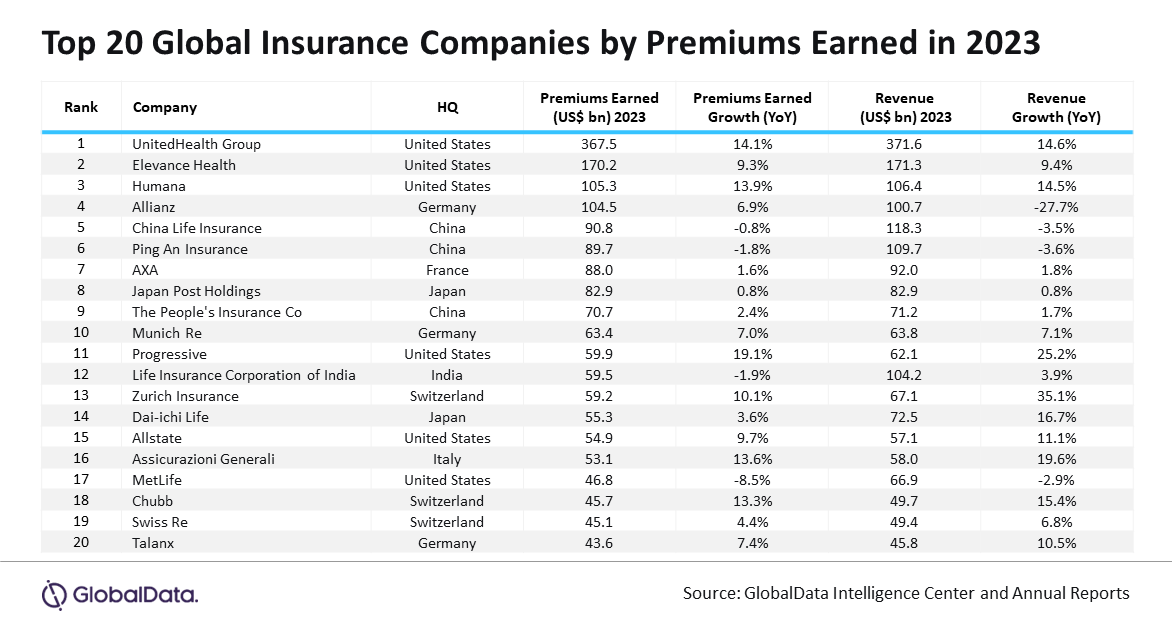

Global insurers see 6.2% growth in average premiums

China Life Insurance topped its regional peers and was in 5th place globally.

In 2023, the top global publicly listed insurance companies continued their momentum, driven by increased awareness of insurance products and economic recovery in most markets.

The average premium earned by the top 20 global insurers grew by 6.2% year-on-year (YoY), with an overall top-line increase of 7.8% YoY, GlobalData revealed.

Amongst the top 20 insurers, 16 reported YoY growth in premium earnings, with Progressive, UnitedHealth, and Humana standing out.

Progressive Corporation saw a 19.1% YoY growth in premium earnings due to its strong market share in the US private passenger auto insurance market.

UnitedHealth Group experienced increased premiums within its UnitedHealthcare division, largely due to the strong performance of its Employer & Individual business segment, which serves over 27 million people with access to medical services.

Humana achieved a 13.9% YoY increase in premiums to $105.3b in FY2023, focusing on Medicare Advantage plans. Investments in digital health solutions and strategic partnerships have further boosted its growth, solidifying its position in the health insurance sector.

On the downside, MetLife's earned premiums declined by 8.5% YoY due to a significant drop in its Retirement & Income Solutions business, mainly driven by a large pension risk transfer transaction in 2022.

From a regional perspective, six Asia-headquartered insurers were included in the top 20 performers.

The Life Insurance Corporation of India, however, was one of the insurers that saw a slight decline in premiums by 1.9% YoY to $59.5b. This was attributed to economic challenges in India and rising competition from private insurers.

Other insurers included Dai-ichi Life (3.6% YoY, 14th rank), The People’s Insurance Co. (2.4% YoY, 9th), Japan Post Holdings (0.8% YoY, 8th), Ping An Insurance (-1.8% YoY, 6th), and China Life Insurance (-0.8% YoY, 5th).

Advertise

Advertise