India could soon allow customers to take out loans to buy insurance

The regulator is currently studying a proposal for premium financing.

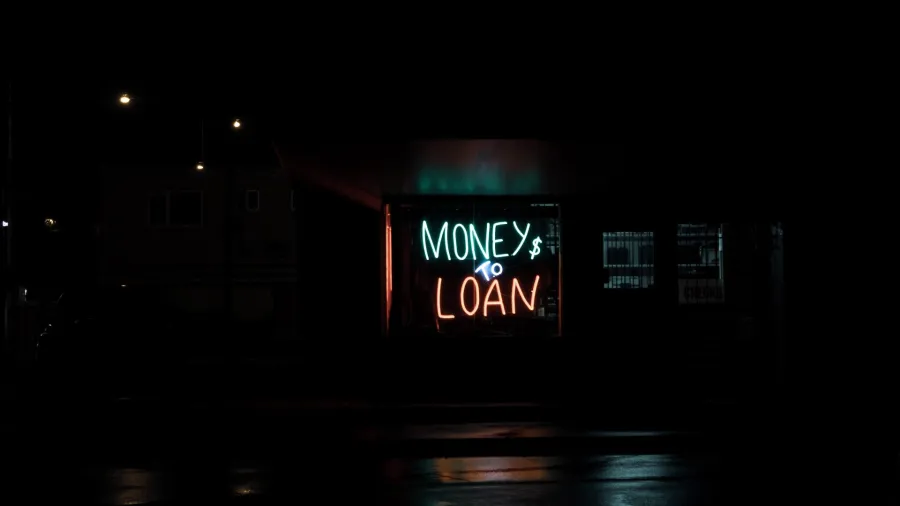

Retail and corporate customers in India may soon be allowed to take out loans to purchase insurance as the Insurance Regulatory and Development Authority (IRDAI) examines a proposal for premium financing.

Premium financing uses borrowed money to pay for insurance premiums. This allows premium payment to spread over a longer duration. Currently, this purchase method for insurance is not available in India.

A report by the Economic Times said a senior executive who was not named said that the move is aimed at increasing insurance penetration, retention, reducing protection gap, and also creating new avenues of consumer and corporate financing.

"It is being looked at. Necessary amendments will be required in the Insurance Act, for which the government also needs to be on board," the executive said.

*****

You may also like:

Allianz Asia Pacific hires new COO

Kyobo Life to issue $500m hybrid bonds

EXCLUSIVE: Why this SG-based fintech firm is ending the pen-and-paper era of financial advisors

Advertise

Advertise