India’s general sector premiums seen to rise in the medium term

The sector has also benefitted from favourable investment conditions.

India’s economic development, rising insurance demand, and regulatory reforms aimed at increasing insurance penetration and financial inclusion will drive the country’s non-life insurance premiums in the medium term, AM Best said.

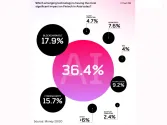

The sector achieved double-digit premium growth in fiscal year 2024 ending 31 March (FY 2024), with health and motor insurance driving performance.

The Insurance Regulatory and Development Authority of India (IRDAI) introduced several initiatives under its "Bima Trinity" framework to support sustainable growth and its vision of "Insurance for All by 2047."

These include "Bima Sugam," an electronic insurance marketplace; "Bima Vistaar," a bundled insurance product covering life, health, personal accident, and property risks; and "Bima Vaahak," a women-centric distribution channel.

Other reforms include liberalising the insurance market, standardising products, and leveraging technology to improve distribution efficiency.

India’s economic growth, which reached 8.2% in FY 2024 due to government infrastructure spending and increased household consumption, is expected to further benefit the non-life insurance segment.

However, signs of an economic slowdown have emerged, although monetary and fiscal policies are anticipated to support future growth.

Indian non-life insurers have benefitted from favourable investment conditions, with the Reserve Bank of India maintaining the repo rate at 6.5% since February 2023.

The IRDAI’s updated "expenses of management" regulation, introduced in March 2023, seeks to improve cost efficiency and underwriting discipline by imposing stricter expense limits.

Whilst the industry has yet to fully comply, these measures are expected to enhance operational sustainability and competitiveness over the medium term.

Despite premium growth, the sector faces persistent underwriting losses due to pricing discipline issues, fraud, and intense market competition, particularly in health and motor insurance.

The recent liberalisation of tariff wordings, effective 1 April 2024, allows insurers to amend policy terms for certain business lines, enabling product innovation and better risk management for experienced players.

However, in the short term, this flexibility may lead to looser underwriting practices and increased pricing pressure in an already competitive market.

Advertise

Advertise