Singapore’s retirement income system is the best in Asia: report

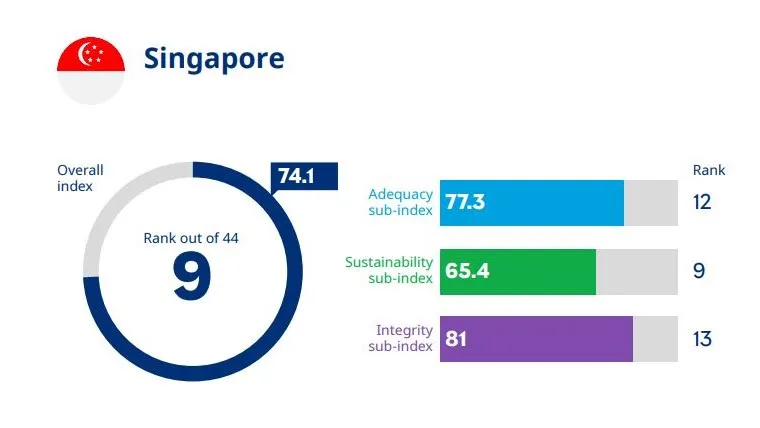

It also ranks 9 out of 44 globally.

Singapore’s retirement income system is the best in Asia and ninth globally based on the Mercer CFA Institute Global Pension Index Report.

Singapore has an overall index score of 74.1. It scored 77.3 in Adequacy, 65.4 in Sustainability, and 81 in Integrity sub-indices.

ALSO READ: How do Hong Kongers fare in their retirement preparations

Hong Kong ranks second with an overall index score of 64.7, followed by Malaysia (63.1), China and Japan (54.5), and Taiwan (52.9).

Singapore’s index value increased from 70.7 in 2021 to 74.1 in 2022, primarily due to the revised scoring and an increase in the net replacement rates.

According to the report, Singapore’s overall index value could be increased by:

- Reducing the barriers to establishing tax-approved group corporate retirement plans

- Opening up CPF to non-residents (who make up a significant percentage of the labour force)

- Increasing the age at which CPF members can access their savings set aside for retirement as life expectancies rise

- Improving the level of communication provided to CPF members

Mercer’s Global Pension Index overall score is measured by calculating the three sub-indices. The first is Adequacy, which takes into account, benefits, system design, savings, government support, home ownership, and growth assets. The second is Sustainability which measures pension coverage, total assets, demography, public expenditure, government debt, and economic growth. The last is Integrity which measures regulation, governance, protection, communication, and operating costs.

Advertise

Advertise