Thai general insurance GWPs to hit $10.6b in 2025: report

Growth is expected to recover from 2022 onwards and will witness an upward trend.

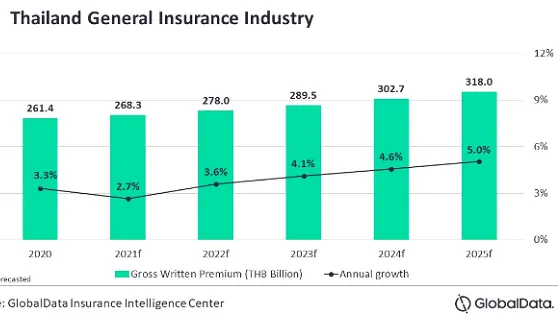

The general insurance industry in Thailand, in terms of gross written premiums, is projected to reach $10.6b (THB318b) in 2025, according to a GlobalData report.

Industry growth slowed to 3.3% in 2020 versus the 4.6% growth registered in 2019 due to the pandemic. Growth is expected to recover from 2022 onward and will witness an upward trend, supported by the gradual economic recovery.

Motor insurance is the largest general insurance segment, accounting for 56.3% of GWPs in 2020. Lower automobile sales due to lockdown restrictions along with economic disruptions negatively impacted growth, which declined to 1.5% in 2020.

However, the segment is seeing signs of recovery due to gradual easing of lockdown restrictions, improved consumer demand and government stimulus measures. According to the Federation of Thai Industries, domestic car sales during January-April 2021 increased by 9.6% on a year-on-year basis to reach 252,269 vehicles.

Personal accident and health insurance, which held 19.3% of general insurance premiums in 2020, is expected to grow by 6.9% during 2020 to 2025. Health insurance, with 6.6% share in premiums, was the fastest growing segment registering 37.1% growth in 2020.

An aging population, rising demand for COVID-19 health insurance policies, and increasing awareness supported health insurance growth, the report said.

Advertise

Advertise