In Focus

Insurance firms tap into big data for new products

Total assets of the 50 largest insurers went down 6.47% to $217b in 2019.

Insurance firms tap into big data for new products

Total assets of the 50 largest insurers went down 6.47% to $217b in 2019.

Beyond Japan: Sompo Holdings Asia's journey towards a sturdy retail platform

The insurer seeks to build and reinforce brand awareness for direct consumers in key Asia Pacific markets.

Singapore's new business premiums in life insurance up 1% to $687.16m in Q1

The uptake in annual premium buys offset the decrease in single premium product purchases.

APAC insurance deals up 40% in 2018: report

There were 59 completed M&As last year from 42 in 2017.

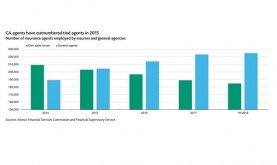

Korea cracks down on third-party agent selling

The move will enhance transparency and reduce risk of mis-selling.

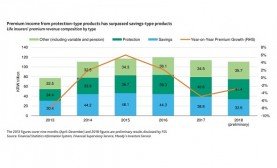

Korean life insurers hit by short-term pain in shift towards protection products

Savings type products require higher capital charges and offer less attractive margins.

Insurance gross premiums in Singapore up 3.4% to $3.81b in 2018

The motor insurance segment’s underwriting profit jumped 137% to $9.96m.

Insurance pricing in Asia up 0.4% in Q4

This represents the first increase in composite price in four years.

APAC's life and P&C insurance sector will remain stable in 2019: Moody's

Ageing populations will boost demand for long-term investment and health coverage.

Japanese non-life insurers burned by fire premium losses

Insurance firms are bearing the weight of losses brought about by natural disasters.

Chinese P&C insurers' digitalisation efforts beat Hong Kong and Japan

Ping An P&C’s motor insurance service uses image recognition to provide repair estimates based on submitted pictures.

Are you an ecosystem insurer?

Analysts say that the rewards for working in a digital ecosystem are worth the effort.

Fire insurance in Japan receives profit boost to offset dismal auto underwriting

The advisory rate revision will reflect increased losses from natural catastrophe and water leakages.

Chinese insurers shun universal life policies to ensure sustainability

These are commonly structured as short-term savings products.

Singapore battered by massive $669.97b mortality and critical illness gap

This represents the gap residents must cover in case of emergencies rendering them unable to work and provide for their families' financial needs.

How must insurance firms in Singapore play the game of digital catch up?

The “wait and see” attitude is holding back insurers from being early adopters of digital transformation.

Where are the drones in insurance?

Are wearables the closest thing to drones in the insurance sector?

Advertise

Advertise

Commentary

Firewalls are never enough