Ciputra Life goes beyond its captive market by addressing customer pain points

Its customer-centric approach results in 60% non-captive customers

As part of the formidable Ciputra Group in Indonesia, Ciputra Life bears the advantage of a captive market across an extensive corporate network. Yet, it is devoted as an insurer to answer to customer needs and pain points by crafting personalised solutions that have not only kept its inherent customers but also attracted a growing number of non-captive clients.

Thanks to its parent companies, Ciputra Life is in an unique position due to its shareholder support from property industry and motor vehicle industry giants from which it naturally draws its clientele: vehicle and property buyers.

In Indonesia, approximately 60%–70% of property or housing buyers use KPR (Housing Credit); 20%–30% pay in instalments; and around 10% buy in cash. For vehicle purchases, 70%–80% of buyers avail themselves of leasing, whilst 20%–30% pay in cash.

These numbers are crucial to Ciputra Life CEO Hengky Djojosantoso, who explained to Insurance Asia that since they mainly provide credit life insurance products, they take the role in this market as a layer of protection for debtors.

“So that when debtors experience a disaster, family members are not inherited with the credit burden, but the insurance company will pay off the remaining outstanding loan,” said Hengky.

These debtors are Ciputra Life’s captive market, which they reach through shareholders Ciputra Group and Tunas Group, in addition to banks for bancassurance, of course.

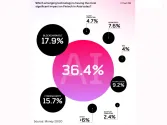

But interestingly, 60% of Ciputra Life’s current customers come from their non-captive market, an achievement that can be credited to its customer-centric approach that appeals to clients beyond their ambit of influence.

Captive market dynamics

The Ciputra Group is behind more than 76 property projects spread across 33 cities in Indonesia with a total development area of 7,000 ha. Tunas Group, on the other hand, is a motor vehicle dealer of such brands as Toyota, Daihatsu, and BMW. It is also a motor vehicle financing company.

From Hengky’s perspective, Ciputra Life’s connections with these two industry leaders boosts the marketing of their six-year-old company’s insurance products.

The demands can be greater, revealed the insurance boss. Hengky said the requests coming from the group actually exceeded industry standards. “They demand our services to be faster so that the positive side will spur Ciputra Life to move one step ahead of the industry,” he said.

Hengky also made it clear that their captive market is not automatically embedded with their product, so Ciputra Life essentially develops its own approach with a rhythm that adjusts to their group’s property marketing and vehicle leasing activities.

This then allows them to cross-sell and up-sell for each other. “Either we or they can refer to each other’s products,” he said. To illustrate, he said that if he avails himself of insurance at Ciputra Life, he gets an additional discount or bonus for buying a house in the cluster developed by Ciputra Development and vice-versa.

“Even though we have only been operating for six years, the Ciputra brand, which has been embedded in the community for more than 40 years, certainly helps in terms of consumer confidence in us,” he said.

Solving pain points

Having a captive market may be a gift, but Ciputra Life is not one to curl up under its security blanket. Hengky said their organisation is driven to address insurance customer pain points because they understand their clients even down to the simplest of their worries.

He cited that when a customer’s heirs are asked for physical documents during the claims process, Ciputra Life sees this as an inconvenience if not an unnecessary hassle. Yet, certain insurance providers even demand printed documents for various client requests.

This poses challenges, especially when heirs cannot locate the required documents. Ciputra Life takes the simpler approach, said Hengky. “By simply sending a softcopy of their claim documents through WhatsApp or email and then making sure [on our end that] their data is recorded, we can process the claim,” he said.

Also, Ciputra Life offers added value, in addition to the four key factors their organisation considers when designing insurance products: customer needs, pricing, promotion, and convenience.

Whilst 80% of their products are credit life insurance, Ciputra Life also offers health, education, and accident insurance. Hengky noted that they recently introduced a highly personalised product called Ciputra Target Fund Insurance (Asuransi Ciputra Target Dana), which was developed based on customer insights.

Value of customer insights

The first insight when it comes to customers is about people’s desire to be flexible in determining their sum insured. Besides that, Hengky stressed that the customers also wants to determine the specific insurance coverage based on their specific needs.

The second is about people’s expectations for certainty. “For example, within a certain period of time, a customer wants to withdraw his or her funds in a certain amount… we make sure this can be done,” Hengky said, noting Ciputra Life’s commitment to both flexibility and certainty.

The third insight is that people want premium payments that do not take too long. “We found prospective customers want sufficiently long coverage for only five years premium payments,” Hengky said.

For the final customer insight, Hengky said he found that Indonesian do not want their premiums to be forfeited. “Customer wants to get something regardless whether they make a claim or not making any claim,” he said.

Ciputra Target Fund Insurance was designed based on these insights to help customers save for future goals like education, religious travel, inheritance, or weddings.

Hengky explained that they've made this product easy to access through a digital microsite. Customers can input their desired coverage amount, term, and age, and the microsite instantly sends customised proposals via WhatsApp.

Keeping customers connected

Hengky himself sees digitalisation as a way to improve customer experience through new marketing channels. But for customers to feel these improvements, he observed that they had to start from the after-sales side.

He stressed the importance of focusing on customer pain points, with a major one being the complexity of the claims process. “The customer feels the hassle when submitting a claim,” he said.

To address this pain point, Hengky asserted their commitment to simplifying this process digitally, even offering express claims completed in just around 60 minutes.

Apart from that, Ciputra Life also leverages digital channels to educate and better communicate with customers. Through social media platforms, customers are advised on how to purchase their dream home and things to prepare if they want to take home loans, for example.

Into the future

Hengky emphasised the company’s commitment to advancing digitalisation. He told Insurance Asia that there were lessons learned during the pandemic, especially in terms of digital security.

For Ciputra Life, he proudly mentioned their strong information security index from the National Cyber Security Agency (BSSN).

Looking ahead, Hengky pointed to exciting opportunities within the Ciputra Group, which includes Ciputra University and Ciputra Hospital. He underscored their intention to foster collaborations within this network, opening up new avenues for growth and service excellence.

Hengky assured that what Ciputra Life plans for the future, it would be anchored on the growing needs of its customers with a commitment to address their various pain points. “Our products will always be there to answer them,” he said.

Advertise

Advertise