South Korea's insurance industry to reach $191.2b in 2029 with 3.4% CAGR

The life insurance and pension segment accounted for 84% of premiums in 2024.

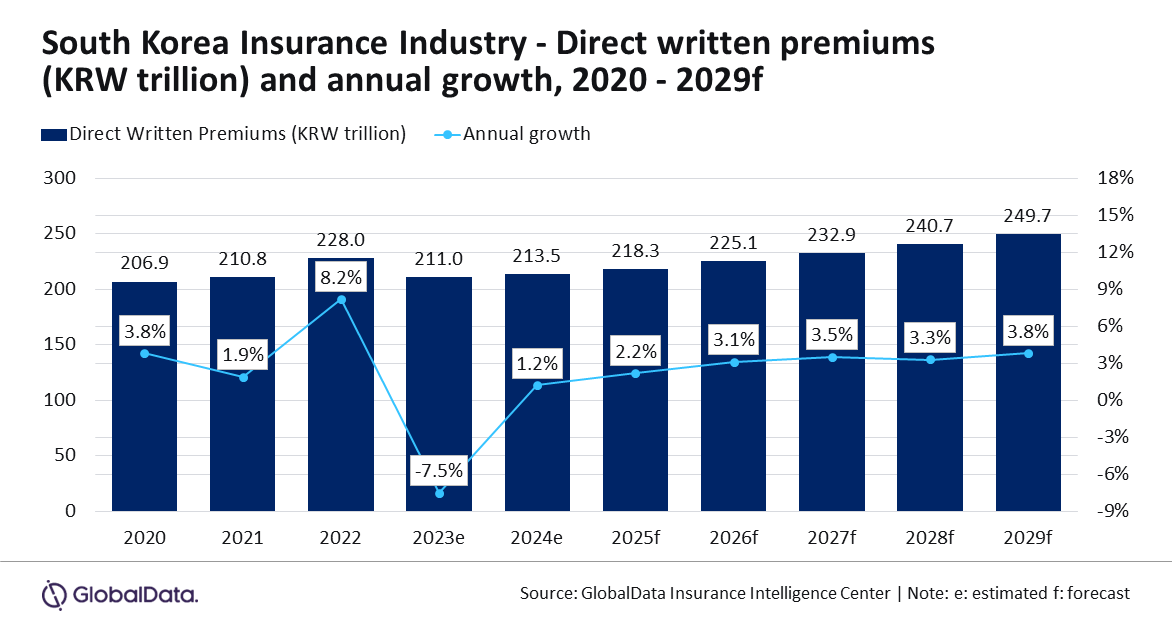

South Korea's insurance industry is projected to jump to $191.2b from $167.1b in 2025 in 2029 with a compound annual growth rate (CAGR) of 3.4%, according to GlobalData.

The industry is set to expand by 1.2% in 2024, supported by shifting demographics and rising demand for health and retirement pension products.

Sneha Verma, an insurance analyst at GlobalData, noted that whilst the market contracted by 7.5% in 2023 due to sluggish economic growth impacting life insurance demand, it is expected to rebound in 2024, driven by economic recovery and an increasing ageing population.

The life insurance and pension segment, which is expected to account for 84% of premiums in 2024, will lead the recovery.

After a 9.3% decline in 2023, the life insurance segment is forecast to grow modestly by 0.5% in 2024, with a CAGR of 3.1% anticipated between 2025 and 2029. This growth is fuelled by South Korea’s transformation into a super-ageing society, with the share of people aged 65 and older projected to rise from 18.4% in 2023 to 39.4% by 2050.

“Increased awareness about health and financial planning will also support life insurance growth in South Korea. The demand for health insurance is increasing due to rising cases of life-threatening diseases," Verma said.

For example, the Central Dementia Centre of the Ministry of Health and Welfare reported a significant rise in dementia cases, with one new patient identified every 12 minutes.

General insurance, comprising 16% of direct written premiums in 2024, is expected to grow by 4.9%. This growth is driven by compulsory lines and increased awareness of liability protection, which is boosting demand for liability insurance products.

Motor insurance, however, is expected to see stagnant growth in 2024 due to declining vehicle sales.

Domestic sales dropped by 10.1% in the first half of 2024 to 800,000 units, compared to 890,000 during the same period in 2023, according to the Korea Automobile Industry Association. Weak consumer sentiment and high interest rates have contributed to this decline.

Additionally, South Korea's vulnerability to natural disasters will support the demand for fire and natural hazard insurance. According to the National Fire Information System, the country experienced 30,316 fire incidents by October 2024, with total losses amounting to $456m.

General insurance is projected to grow at a CAGR of 5.1% between 2025 and 2029.

Advertise

Advertise