Singlife shows traditional insurers how to thrive in the new normal

A product with a wide-reaching coverage and having a strong digital service is the way to go, says CEO Walter de Oude.

The unexpected advent of the coronavirus pandemic has greatly shaken up how Asian insurers interact with their customers. The new normal of a socially distanced society has highlighted the need to digitise insurance so that firms may continue to meet customers’ needs even remotely.

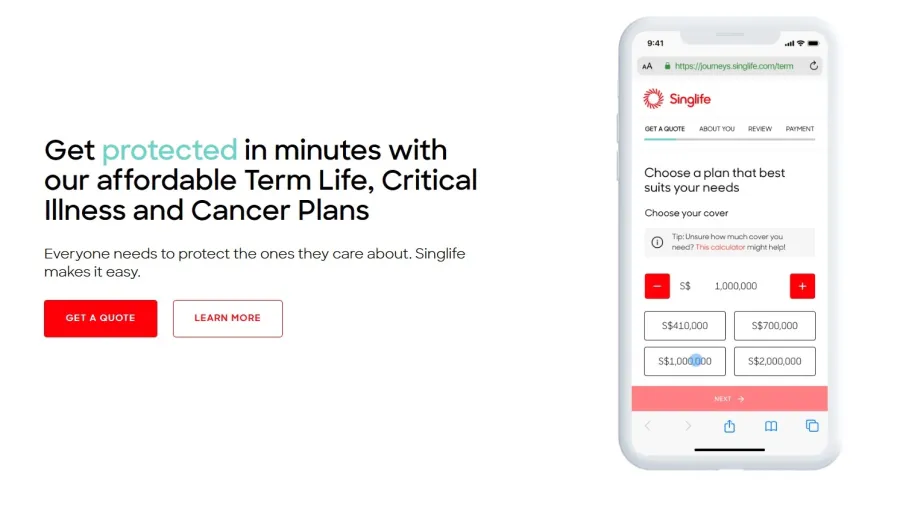

Digital-only insurer Singapore Life (Singlife) has a head start in this change. The company began as a firm looking for a way to digitise life insurance. The firm’s leading product, Singlife Account, gives customers the ability to save their money with a market leading rate of up to 2.5%. To make things easier for customers, Singlife added a Visa card to their account options, allowing customers to spend the money on their insurance contract the same way as you would on an ordinary debit card.

“This is a new and novel product because it's never actually been done before in the industry,” Walter de Oude, group CEO and founder of Singlife, told Insurance Asia in an exclusive interview. “Singlife is the very first insurance company I've ever heard of who is also an approved issuer of Visa cards and we are the first ever insurance company I know of to be able to have a direct debit from your insurance account for payments.”

First launched in March 2020, Singlife Account garnered 40,000 downloads within the first month of release. The numbers further skyrocketed when the circuit breaker measures set in: for the month of April alone, Singlife registered more than 50,000 downloads for its Singlife Account offering.

Insurance Asia caught up with de Oude—founder of one of the first digital-only insurers in APAC—to learn about his thoughts for the future of the insurance industry amidst the new normal of physical distancing, as well as find out more about how Singlife plans amidst changes in the market.

How has COVID pandemic affected insurers’ operations and strategies for growth, particularly in the region?

Singlife is a digital-first insurance company: we offer products through third-party advisors or direct to customers. And what we've found is that with COVID-19 and more people at home, less people are actually spending their money. With lower consumption means there's higher savings, and where there's higher savings, [it means that] people are looking for better places to save their money. So for Singlife, we have been incredibly fortunate that COVID-19 has actually helped us tremendously in ramping up digital propositions because people are looking for a place to save their money and Singlife provides a very neat, easy and convenient one.

Which of your products have most benefited from the surge in interest for digital products and services?

The products that have benefited the most from COVID-19 would be the simple savings product. So for a Singlife Account, we have passed more than 50,000 downloads in April, during the circuit breaker measures.

What challenges is the insurance industry facing now given current market conditions?

So the biggest challenge that the industry has faced is in face-to-face sales. With low social contact, it's been very difficult for advisors to adjust to a new way of meeting with people, which is digital and online in order to do business. Business is continuing but this adjustment is taking a time to get to grips with. So what we have seen is that face-to-face advice or advisory-related product sales is taking a big fall in the second quarter. But what it has meant, though, is that advisory-related services on traditional insurance companies have had to readjust or rethink how they're engaging with customers in a non face-to-face way and to allow a little bit more leniency in how they accept non face-to-face transactions. The changes that we're seeing around us is that face-to-face advice includes much more ability to do Zoom or WhatsApp, amongst others.

But the biggest issue is the ability to have remote signing of application forms, which is transformational for the industry. They've really not done that before, but COVID-19 has actually forced most players in the industry to change their views such that signing forms remotely is now more acceptable than it's ever been before. For Singlife, we've always accepted this because it's part of our business model, and we can validate authenticated forms digitally. But the rest of the industry is still catching up.

What are some trends arising in the industry due to current market conditions, which insurers can take advantage of?

People have got more time to take care of their personal finances than they have had previously, and they are saving more than they've done previously. This has benefited digital companies. In particular, Singlife is able to service [our customers] remotely. It's the company's responsibility to find new ways in which to engage people with these needs to provide them with valuable services.

What is Singlife doing to meet new needs and expectations?

Singlife is built digital so we have not have to change any of our processes to survive a social distanced world. Singlife advisors have always been able to provide products remotely. So we changed nothing in our process and because we are well-prepared for this, because digital is our DNA, we are able to survive and flourish in the COVID-19 times in both face-to-face advice as well as a digital product distribution making mechanism.

In a recent speech, MAS managing director Ravi Menon noted that we might see strong growth in the take-up of pandemic risk insurance. Has there been an increase in interest and take-up of pandemic-related insurance?

We've seen that some of these products have become available in the market. However, our view is that most companies that have offered pandemic-style insurances are a little bit gimmicky in their offer, and are trying to create talking points around coverages that are not as meaningful as might be required.

The pandemic itself has raised the awareness for the need for risk protection, not just for pandemic risk but for all risks. We think that pandemic-style insurance should be incorporated in every ordinary cause of insurance. We think that people shouldn't have to worry about what is not covered for this insurance and then think "I need a special insurance for this." It should already be covered in your ordinary course, day-to-day insurance. So Singlife has got no exclusions for COVID-19-related claims, which we hope will give people the peace of mind that they are covered.

I believe that if people are already covered by their life insurance, then having an additional pandemic-specific insurance on top of their life insurance is a little bit sensationalistic. People should be covered about their broader mortality or health risks rather than just worry about such a small, tiny component of it.

What is Singlife's edge in this new normal way of promoting insurance?

Singlife is already future-ready because we are able to engage directly with customers wherever they're at. We have provided capability frameworks to our third-party advisors, which allows them to engage with their clients in a digital and remote way and still provide Singlife products to those customers. So we're quite well prepared.

I think there are still things that are going to have to take some time. I think the next challenge for us all is not just about digital execution of life insurance. I think the next challenge is around getting the medicals and things done in a way which is efficient. In this time, people are not so willing to go for medical assessments and people are avoiding healthcare at the moment. So there are some challenges to overcome there. But time will make that better.

Can you tell us more about your products and services?

Singlife has just recently launched a single account in March of 2019. That has performed very well. As I said, Singlife account is a very simple savings plan providing up to 2.5% returns for the first $10,000 to customers with no lock-ins, free foreign currency, no charges and a Visa card that attaches to it so that you can effectively access your money at any time. That's never been done before and is a real innovative example of the evolution of insurance.

Now on the back of that, we will be expanding the proposition to be able to allow for simplified issue life insurance that goes off the back of the Singlife accounts in the app and quite a lot more product versatility coming through the fact that we're able to engage directly with, and meaningfully with, customers on a day-to day-basis.

Can you share Singlife’s plan to adapt and thrive in this “new normal” of social distancing and health caution? How would you describe a future-ready insurer?

Singlife is planning on taking over the world. We think we can do things cheaper, better, and faster than the incumbents, and we can innovate, deliver, and create product capability and efficiency in a way that has never been done before, which gives us some fantastic advantage. I think that our growth story will reflect that we will be taking on larger and larger market share over time with a view to just providing good quality, affordable, relevant products to our clients in an easy, convenient and meaningful way. And if we keep doing that, we believe that people will keep supporting us both from a direct way and also through their financial advisors.

Advertise

Advertise