Singapore

HSBC Singapore completes legal integration of AXA

HSBC Singapore completes legal integration of AXA

This enables HSBC to begin its insurance operations in Singapore.

Singapore Business Review’s Insurance Rankings sees slow growth amongst top 50 insurers

The top 50 insurers saw 5.1% growth in 2021.

Chubb taps Malaysia unit COO as new Singapore country head

The role is for the insurer’s general insurance operations in the country.

Tokio Marine Life Insurance Singapore wins for its social and marketing initiatives in the Insurance Asia Awards 2022

Tapping into New Demographics and Giving Back to the Community.

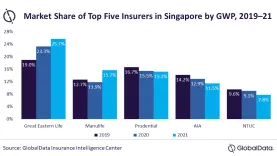

Singapore insurers to profit over shift to digital initiatives: GlobalData

The market share of the top five insurers grew by 3.2 percentage points in 2021.

MSIG partners with AXA to offer travel insurance to Scoot customers

Travel is expected to pick up as one in five said they plan to take a trip.

GIA’s system detects fraud overlooked by insurers

The Fraud Management System uses data analytics and AI that analyse suspicious claims.

Motor insurance growth slows down in Singapore

Higher taxes led to lower car sales in August.

Singapore life insurance new business premiums down by 5.9% in Q3

However, take up for new policies picked up by 12.8% in the quarter.

Great Eastern’s profit attributable to shareholders dips 12% to $780.9m in 9M22

The decline was due to lower valiant of investment in the shareholder’s fund.

Cover Genius bags $70m in Series D funding round

The round was led by Dawn Capital.

Singapore launches digital banker’s guarantee, insurance bond

The eGuarantee@Gov is available from over 20 financial institutions locally.

Singaporeans can now access consolidated views of their insurance policies

Deputy Prime Minister Lawrence Wong announced this during the SFF 2022.

KoverNow: The Netflix of insurance?

Its subscription model gives another option for consumers that don’t want long contracts.

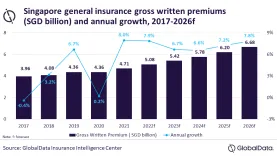

Investment-linked life insurance boosts Singapore’s life insurance industry

ILI products grew by 30% in 2021 and are expected to grow further by 9.8% this year.

Tokio Marine to lead bolttech’s Series B funding round

The investment will raise the insurtech firm's value to $1.5b.

Singapore’s retirement income system is the best in Asia: report

It also ranks 9 out of 44 globally.

Advertise

Advertise