In Focus

Changes in insurance regulations spark industry transformation in 2024

MSIG Asia CEO hails 2024 as a year of growth for insurers, but cautions on varying regulatory and socioeconomic impacts.

Changes in insurance regulations spark industry transformation in 2024

MSIG Asia CEO hails 2024 as a year of growth for insurers, but cautions on varying regulatory and socioeconomic impacts.

Seven of 10 shoppers want protection for purchases but prefer low-cost

The survey also showed more trust in social media marketplaces versus the companies selling goods through these platforms.

Singaporeans struggle with critical illness coverage despite reduction in protection gap

AIA SG’s chief marketing and proposition officer expects insurers to keep up with consumer demands better in 2024.

To lead and to lag: APAC insurance’s conflicted AI journey in 2024

Whilst AI investments reached 23.93% of the total market, 41% of firms in Asia Pacific cling to outdated tech, hindering efficiency and scalability.

Insurance rides high on surge in Hong Kong travellers

CEO Jim Qin of Zurich Insurance cites a trend for extended vacations among Hongkongers in 2023, boosting travel insurance sales.

Chinese life insurance set for 9% annual growth, to reach $893b by 2028: GlobalData

Increased awareness of health and better financial planning are a few of the growth drivers of China’s life insurance sector.

Mainland Chinese tourists fuel growth in Hong Kong’s life insurance market

The industry will grow 4.1% by 2028 due to more mainland tourists and the super aging population.

Economic slowdown challenges insurance underwriting; emerging markets show promise

Swiss Re Institute analyst underscored that real premium growth in emerging markets, including China, outpaces the more advanced economies.

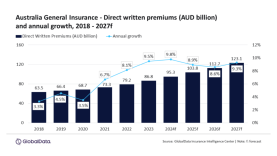

Australia’s general insurance sector to surge 9.1% by 2027

The industry is seen to grow by 9.5% in 2023 and 9.8% in 2024.

Rising S’pore EV registrations prompt insurers to evaluate premiums and coverage

Plugging into Lion City’s 80% emission cut goal, EVs bring progress and new risks for motorists.

Swiss Re upbeat about growth of insurance sector

As a cautionary note, an economist said fixed annuities face potential decline as higher Interest rates shift consumer preferences.

See you in 2024!

We’re taking a short break.

Hong Kong’s top 50 insurers experience 7.7% YoY premium contraction in 2022

Analysts said the market’s complex financial environment and shrinking population curtailed industry growth. Cross-border expansion could alleviate contraction pains.

Singapore’s top 50 insurers see 3.7% YoY asset decline in 2022

Experts’ industry outlook for 2023-2024 centres on digital evolution with AI, protection gaps, strategic partnerships, and resilience amidst challenges.

Arthur D. Little sees embedded finance growth to $350b in 2024

Generative AI and the expansion of fintech brands into the insurance sector are predicted to propel the industry’s advancement to new heights.

Swiss Re: Asia’s insurance players target health industry in 2024

In Singapore, shifting focus to health underscores the need for insurance players to close the protection gap that has remained unchanged in the last 5 years.

Thailand’s general insurance market to generate $11b by 2027 – GlobalData

Motor insurance accounts for 54.8% of the GWP in 2022, and is expected to grow by 5.6% in 2023.

Advertise

Advertise

Commentary

Firewalls are never enough