Swiss Re warns motor insurers on rising claims pressures

Last year saw 90 million car sales, which required mandatory motor coverage.

Swiss Re warns of a cautious mid-term outlook for the motor insurance sector, amidst rising claims costs, evolving mobility trends, and continued economic and environmental pressures.

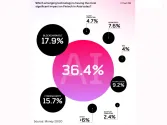

Motor insurance, which accounts for approximately 40% of the $2.2t property and casualty insurance sector, is under pressure from multiple directions, Swiss Re’s “Shifting gears in a changing landscape - A global perspective of motor (re)insurance” report showed.

In 2024, nearly 90 million light vehicles were sold globally, all requiring mandatory motor insurance covering third-party liability and vehicle damage.

Whilst accident frequency has declined—partly due to improved vehicle safety features and reduced driving distances post-COVID—accident severity has increased due to higher speeds and distracted driving.

Simultaneously, the growing complexity of modern vehicles and inflation are pushing up repair and medical costs, adding pressure on insurers' bottom lines.

New tariffs are expected to increase claims severity further. With spare parts in short supply and supply chains under strain, repair times and costs are expected to rise.

Weather-related events such as floods and hailstorms are also contributing to higher motor-own damage losses, which may not yet be fully priced into current premiums.

Laure Forgeron, Chief Underwriting Officer Casualty at Swiss Re, said rising claims costs and supply chain disruptions are reshaping the market, which must now also adapt to a technological shift in mobility.

“Vehicles of the future will be more connected, autonomous, shared and electric, and insurance must be tailored to fit this new reality,” Forgeron said.

In Asia-Pacific, the market is undergoing significant change. Laurel Hu, head of Casualty Underwriting APAC at Swiss Re, said that EV adoption, tech integration, moderate inflation, and increasing medical costs are all reshaping how insurers approach motor coverage in the region.

COVID-19 also had a lasting impact, initially altering driver behaviour and later contributing to claims inflation due to part shortages.

Whilst many markets have yet to return to 2019 driving levels, competition in motor insurance is rising again following price corrections.

Regulatory shifts are another challenge. In some countries, deregulation, such as that seen in India—is encouraging product innovation but raising fraud risks.

Furthermore, profitability remains under pressure despite stable claims inflation in China. The increasing frequency of natural catastrophes and short-term impacts from EV integration are affecting motor insurance performance.

Advertise

Advertise