Indian life insurance sector to shrink 0.9% this year

The sector has reported a 32.6% decline in new business premiums in April.

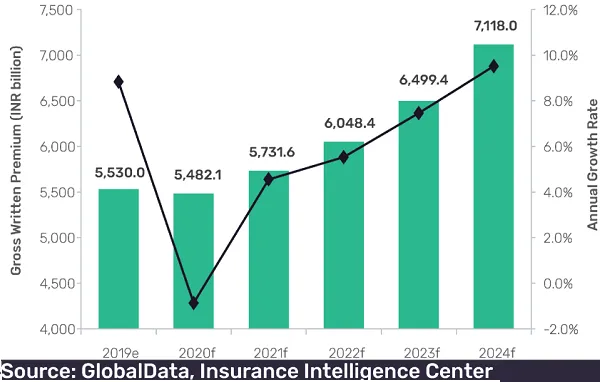

India’s life insurance sector will contract 0.9% this year from an 8.8% growth posted in 2019, according to a GlobalData report.

The industry is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2019 to 2023.

The extended lockdown and related restrictions will have an adverse impact on new business premiums growth this year, as premiums from new business accounts for 42% of the sector. Due to the lockdown, life insurers reported a 32.6% downturn in new business premiums in April against the same period last year, the report said.

For instance, state-owned Life Insurance Corporation of India registered a 32% decline in premiums, whilst private life insurers have seen a 33.3% downsurge during the same period.

“Bancassurance and agency channels account for over 90% insurers’ new business premiums in India. Due to the lockdown restrictions, sales through these channels have been severely impaired,” said insurance analyst Pratyushka Mekala.

To counteract the impact of offline distribution channels, insurers have been making rounds in accelerating online sales. However, growth from online channels will do little in preventing the decline in the overall life insurance business, the report concluded.

Advertise

Advertise