Nat Cat makes home insurance unaffordable in Australia

This could ultimately lead to underinsurance or no insurance at all.

Frequent natural catastrophes are making home insurance unaffordable in Australia and this could lead to a serious underinsurance gap or worse: homeowners opting not to buy insurance at all.

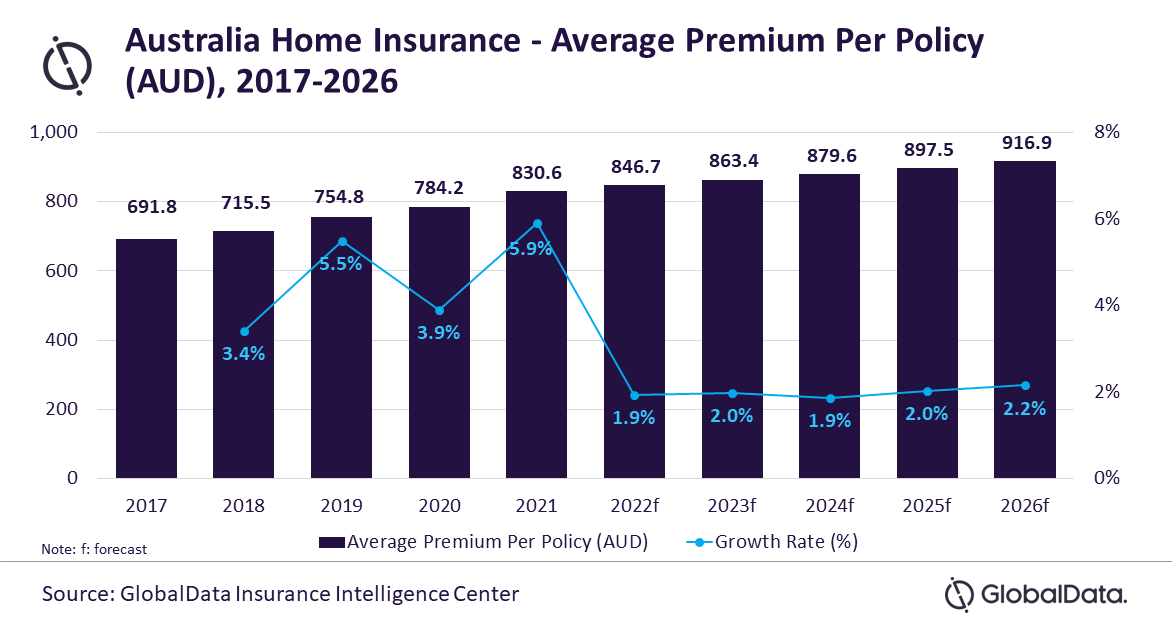

This is because extreme weather events are forcing home insurance premiums to surge. In fact, according to data and analytics firm GlobalData, home insurance premiums in Australia grew by 5.9% in 2021, the highest in the last seven years.

According to GlobalData’s senior insurance analyst Swarup Kumar Sahoo, the impact of natural catastrophe events is most severe on personal property insurance which accounted for 80% of claims that occurred in 2021.

“This will have a significant impact on home insurance premiums as insurers will pass this to the consumers to recover the losses. Rising insurance costs and increased frequency of natural disasters will leave around 4% of Australian homes uninsurable by 2030,” Sahoo said.

According to Sahoo, home insurance prices in Australia registered significant growth after every natural disaster. Northern Australia, which is prone to natural disasters, registered growth in both claims and premiums during the last five years. Natural disasters in 2019 increased average premiums on home insurance by 20% in this region compared to 11% in the rest of Australia.

Recent floods in February and March 2022 which caused an insured loss of US$3.35bn, is expected to further increase home insurance prices in 2022.

“Increase in home insurance premiums will lead to underinsurance or no insurance as lower and middle-income groups will look to reduce policy coverage if they are unable to afford high premiums,” Sahoo said.

This analysis was similarly echoed by the Climate Council of Australia.

According to the council, about one in 25 homes or 520,944 properties in Australia are in danger of being uninsurable by 2030, due to rising risks of extreme weather and climate change.

This number increases to one in seven homes within Australia’s top 10 electorates most at-risk of climate impacts.

According to the report of the Climate Council, across all electorates in Australia, 3.6% of properties (520,944) or one in every 25 properties will be uninsurable by 2030. In addition, one in 10 (9%) of properties will reach the ‘medium risk’ classification by 2030, with annual average damage costs equaling 0.2% or more of the property replacement cost.

The report also found out that riverine flooding poses the biggest risk to properties. Of the properties classified as ‘high risk’ by 2030, the majority (80%) of that risk is due to riverine flooding.

You may also like:

EXCLUSIVE: No man left behind: How insurtech is solving the underinsurance mess

Advertise

Advertise