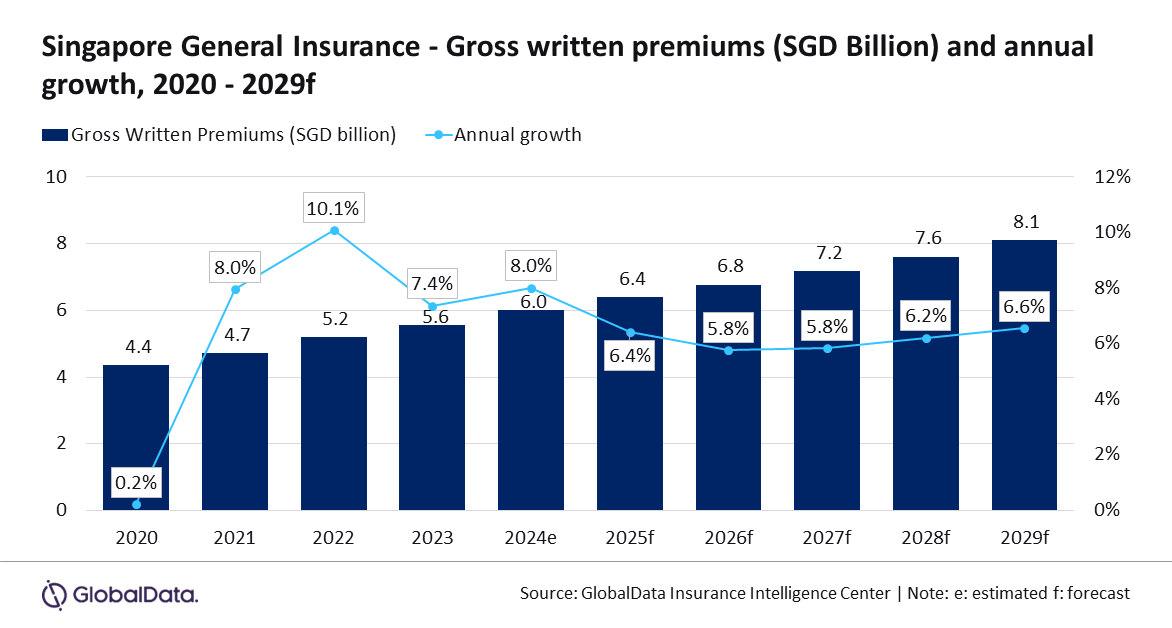

Singapore’s general insurance industry to grow 6.2% CAGR by 2029

The industry is expected to expand by 8.0% in 2024.

Singapore's general insurance industry is projected to register a compound annual growth rate (CAGR) of 6.2%, reaching $5.9b in gross written premiums (GWP) by 2029, up from $4.4b in 2024, according to GlobalData.

The industry is expected to expand by 8.0% in 2024, driven by economic recovery, rising healthcare costs, and higher premium rates.

Senior insurance analyst Swarup Kumar Sahoo noted that growth in recent years has been supported by strong construction sector performance, with rising healthcare costs and an ageing population continuing to boost demand for health insurance.

Personal accident and health (PA&H) insurance is expected to remain the largest business line, accounting for 23.5% of GWP in 2024.

It is forecast to grow by 9.0% next year, fueled by escalating medical costs.

MediShield premiums, part of Singapore’s national health insurance scheme, will rise by up to 35% starting April 2025, contributing to growth in PA&H insurance, which is projected to expand at a 6.9% CAGR from 2024 to 2029.

Motor insurance, the second-largest segment, is set to account for 19.8% of GWP in 2024, with a projected growth rate of 9.4%.

This is attributed to a 30% year-on-year increase in vehicle registrations during January-October 2024, according to the Land Transport Authority, alongside rising electric vehicle (EV) sales.

Singapore’s target to phase out internal combustion engine vehicles by 2040 has further spurred EV adoption. Motor insurance is expected to grow at a 4.1% CAGR through 2029.

Property insurance, making up 18.1% of GWP, is forecast to grow by 5.4% in 2024, supported by an increase in construction demand.

The Building and Construction Authority estimates construction demand will range between S$32b and S$38b in 2024, compared to S$33.8b in 2023.

New public infrastructure projects are expected to drive property insurance to a 6.6% CAGR during 2024 to 2029.

Liability insurance is projected to hold 17.6% of GWP in 2024, with growth supported by mandatory policies such as professional indemnity and employer’s liability insurance, which accounted for 78% of liability insurance in 2023.

This segment is forecast to grow at a 6.0% CAGR through 2029.

Marine, aviation, transit, financial lines, and other general insurance products will collectively account for the remaining 20.9% of GWP in 2024.

Sahoo cautioned that whilst the general insurance industry is positioned for sustained growth, global economic volatility and geopolitical uncertainties could challenge profitability in the coming years.

Advertise

Advertise